This week, I take a look at the latest population movement data for Australia, as well as the growth in housing finance. There continues to be a tsunami of money targeting a declining number of properties for sale.

Brisbane and Regional Queensland are attracting the most people

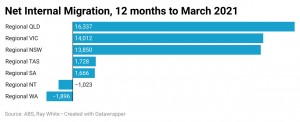

Australia continues to have negative overseas migration but within Australia there has been a lot of movement. In the 12 months to March 2021, Regional Queensland, which includes the Gold Coast and Sunshine Coast, attracted the most people, over 16,000. Brisbane came in second with almost 14,500 people. At the other extreme, Melbourne and Sydney lost the most with most cities losing more than 30,000 people to other cities and to regional areas.

What does this mean for property? Regional areas broadly continue to be the preferred places to move during the pandemic and this will support pricing. The regional areas that are achieving the best price growth continue to be those located close to capital cities such as Sunshine Coast, Gold Coast, Wollongong, Geelong and the Surf Coast, as well as lifestyle areas, particularly the mid north to north coast of NSW. Many of these areas were already doing well prior to the pandemic however changes to the way people work, the search for space and demand for second homes have accelerated demand.

What does this mean for property? Regional areas broadly continue to be the preferred places to move during the pandemic and this will support pricing. The regional areas that are achieving the best price growth continue to be those located close to capital cities such as Sunshine Coast, Gold Coast, Wollongong, Geelong and the Surf Coast, as well as lifestyle areas, particularly the mid north to north coast of NSW. Many of these areas were already doing well prior to the pandemic however changes to the way people work, the search for space and demand for second homes have accelerated demand.

For Queensland, the run of good news continues following last month’s announcement of the Olympics. Right now, there is no stopping the state in terms of its ability to attract more people than anywhere else in Australia.

So much money but not much to buy

New home loan commitments fell a little bit in June but are still at record highs. In June 2021, home loan commitments hit $32 billion and is nearly double what was borrowed in May 2020, the month at which it troughed following the start of the pandemic. It is also almost $8 billion more than the previous peak of May 2017.

An analysis of pre-approval data from Loan Market shows that at this stage, there is unlikely to be a slowdown in the near future. The number of pre-approvals in July were up 65 per cent from last year and more than double the level in 2019. There is still a strong pipeline of money targeting property but unfortunately it is getting harder to find anything.

An analysis of pre-approval data from Loan Market shows that at this stage, there is unlikely to be a slowdown in the near future. The number of pre-approvals in July were up 65 per cent from last year and more than double the level in 2019. There is still a strong pipeline of money targeting property but unfortunately it is getting harder to find anything.

A big challenge this month has been lack of stock. The winter selling season started off incredibly strong but lockdowns throughout July dramatically decreased the number of properties for sale, particularly in Sydney. Best case for buyers? These lockdowns end as soon as possible. Our analysis of previous lockdowns has shown a jump in properties for sale once they end.

Source: Raywhite.com