Vanessa Rader,

Ray White Group Head of Research

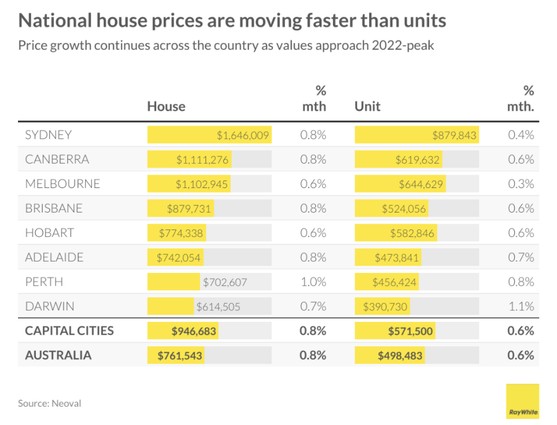

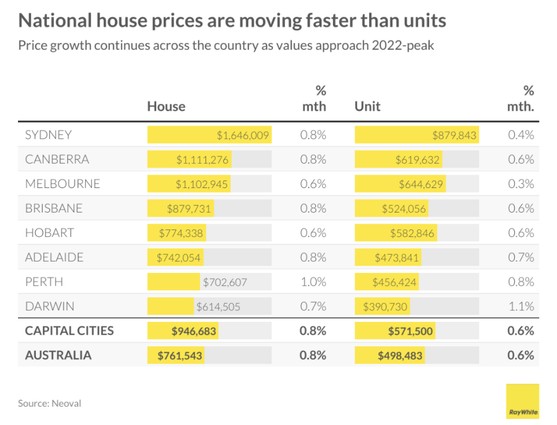

Australian house and unit prices have again jumped up in June, according to the latest house price data report from Neoval. Another interest rate increase in June may have seen some vendors opt for a “wait and see” attitude resulting in limited listing numbers, the outcome of this being a mismatch in supply and demand. But this lack of supply is aiding price growth across the country.

Both houses and units have enjoyed an uptick in values however houses continue to grow at a more rapid pace. Perth houses are leading the charge with a one per cent increase to a $702,607 median. Perth, Brisbane, Adelaide and Darwin house prices have already overtaken peak values recorded during 2022 however, all other markets are on a runway to a similar result with the capital cities house price recording 0.8 per cent gain this month.

With affordability key for many buyers, average unit growth has continued to be robust this month, across capital cities values sit at $571,500 up 0.6 per cent or 3.6 per cent over the last 12 months. Darwin saw the greatest increase up 1.1 per cent this month to $390,730 followed by Perth (0.8 per cent) and Adelaide (0.6 percent). East coast markets historically have been more highly influenced by changing interest rate conditions, impacting borrowing power given the high cost of entry; despite this values in Sydney and Melbourne have witnessed positive monthly gains currently sitting at $879,843 and $644,629 respectively.

Looking over the last year, Sydney has been the stand out performer in terms of house price, up six per cent to $1,646,009 while Brisbane has grown by 5.5 per cent to $879,731, both markets overtaking the Australian annual growth rate of 4.9 per cent. For units, Brisbane leads, up 4.1 per cent to $524,056 while the smaller Adelaide market comes in second recording a 4 per cent improvement both ahead of the Australian growth rate of 3.6 per cent.

This month, the consistency in value appreciation in all states highlights the continued issue of housing supply across Australia. With both monthly and annual results showing upward pressure on price, this has been heavily influenced by the underlying mismatch in demand and supply during this time of increased population growth.

Continued high construction costs are another inhibitor to timely supply entering the market which will likely pressure values for the remainder of this year, edging values across all states back to peak 2022 levels for both houses and units.