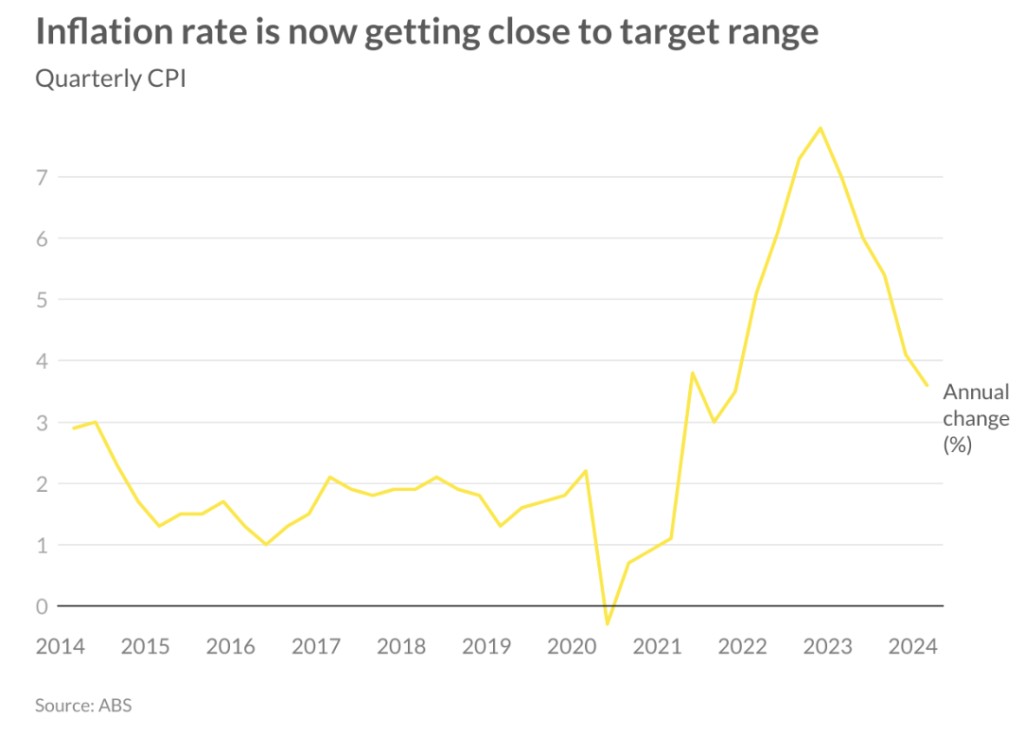

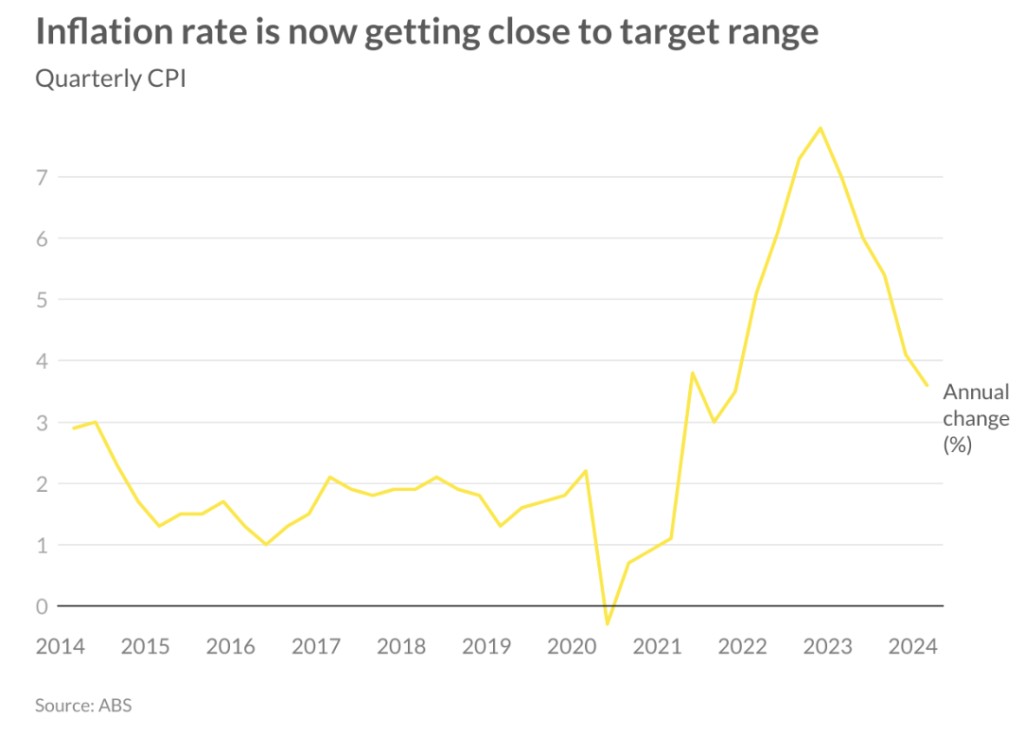

Interest rates remained on hold last week. Inflation is now sitting at 3.6 per cent, higher than hoped, but still showing a decline from 4.1 per cent recorded in December. While it’s great news inflation is coming down, it’s still above the Reserve Bank of Australia’s target of between 2 and 3 per cent and additionally is not coming down quick enough to cut rates in the near future.

The March inflation figures changed the outlook for interest rates dramatically. Whereas on the morning of April 24, markets were pricing in a cut for October 2024, in just 24 hours, this timing had changed to April 2025. Looking at data at this exact point in time suggests no cut in 2024.

However, as we consistently see, the outlook can change dramatically depending on what data is released. The next major data release which could change the outlook significantly are economic growth figures to be released early June 2024. If we see a decline in GDP, it may be enough to push the RBA to move more quickly, perhaps even cutting rates while inflation remains above three per cent.

Globally, the outlook for rate cuts remains variable. The European Central Bank is still on track for a June cut. The UK is now in recession, however, high inflation has now pushed out timing for a cut to the third quarter. In the US, a similar time frame is in place and there is now a minimal chance that rates will be cut three times this year as forecast in early 2024.