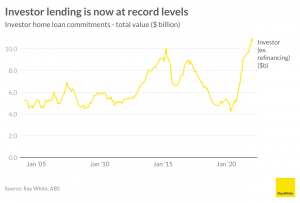

Investor lending is now at record highs

House price growth is clearly slowing but at this stage, this doesn’t seem to be deterring investors. Investor lending activity, according to the Australian Bureau of Statistics (ABS), continues to rise and is now at an all time high nationally.

Investor activity dipped early on in the pandemic. At this time, property prices were declining, rental levels were dropping and a six month ban on tenant evictions was put in place. It didn’t take long however for investors to get back into the market. Lending to investors turned around within just three months and has increased significantly since then.

Where are investors buying? While ABS data can show where the investors are located, it doesn’t provide information on where they are buying. Loan Market does give some indication as to the areas that are popular, but of more interest, those areas where we are seeing a big increase in popularity.

The locations where investors are buying the most are Sydney ($2 billion over the past 12 months), followed by regional Queensland ($1.7 billion). The areas where we are seeing the biggest increases are Darwin, regional Tasmania and regional Western Australia.

What’s driving the increases in these smaller markets? For Darwin and regional Western Australia, it is likely rental growth that is one of the main attractions. Darwin’s rents have increased by 30 per cent since the start of the pandemic, while regional Western Australia’s rents have increased by 38 per cent. Regional Tasmania hasn’t seen so much rental growth however Hobart has become very expensive and it is likely that investors are looking more broadly across the state.

What is the outlook for investor activity? Investor activity generally reduces in quieter markets, primarily because quick buying and selling of property doesn’t offer the same gains as in a faster market. One positive however that could keep them there will be rental growth which continues to be strong – this switch from high capital growth to high income return would likely be a positive for many.

Source: Ray White Now