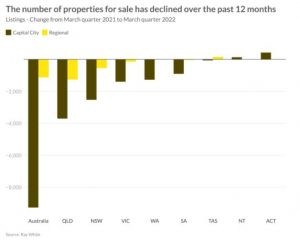

Where have all the properties for sale gone?

Now is a much better time to be a buyer than last year. The market is no longer moving so quickly and in some places, prices are starting to fall. Last year was the year for sellers, now conditions are more in the favour of buyers. The problem is that with conditions softening, sellers are no longer so keen to go to market. This means that although properties may be a bit cheaper, it is really hard to find one to buy with 11,000 fewer homes for sale in the March quarter compared to the same time last year.

The situation is most challenging in Brisbane where there are 3,700 fewer properties for sale, followed by Sydney with 2,500 fewer. This is interesting because Brisbane is still a strong market, while Sydney is looking comparatively weak. It may be that Sydney sellers are driving the drop in volume by holding off going to market, while in Brisbane buyers are snapping up listed properties quickly.

The regional area where we are seeing the biggest decline is regional Queensland where listings have dropped by 560. The decline is pretty consistent for both houses and units.

By suburb, the biggest declines are now occurring in suburbs which have been most challenged through the pandemic such as university suburbs (Carlton and Clayton), as well as high development areas (Melbourne CBD and Rhodes unit markets). Melbourne CBD units, for example, have seen an almost 30 per cent decline in rents and prices through the pandemic as a result of poor tenant and buyer demand. Now that borders are open again, it is likely that we are at the bottom of the market for this market. The drop in listings could be a sign that investors are seeing value in buying properties in these suburbs.

What can this analysis tell us about the state of the market? The drivers of what is happening are different in each market. Strength in buyer activity is likely driving down listings in Brisbane and places like Melbourne CBD and Rhodes. In Sydney and Perth, there is likely a hesitancy amongst sellers given prices softening over the past quarter.

It is quite a different situation to what is happening in New Zealand. Like Australia, prices are softening in New Zealand. In New Zealand however, listings are increasing as a result of properties not selling. With a lot of people wanting to sell, and not much demand from buyers, this suggests greater stress in the market. It is likely that price declines in New Zealand will be a lot sharper than in Australia over the next 12 months as a result.

Source: Ray White Now