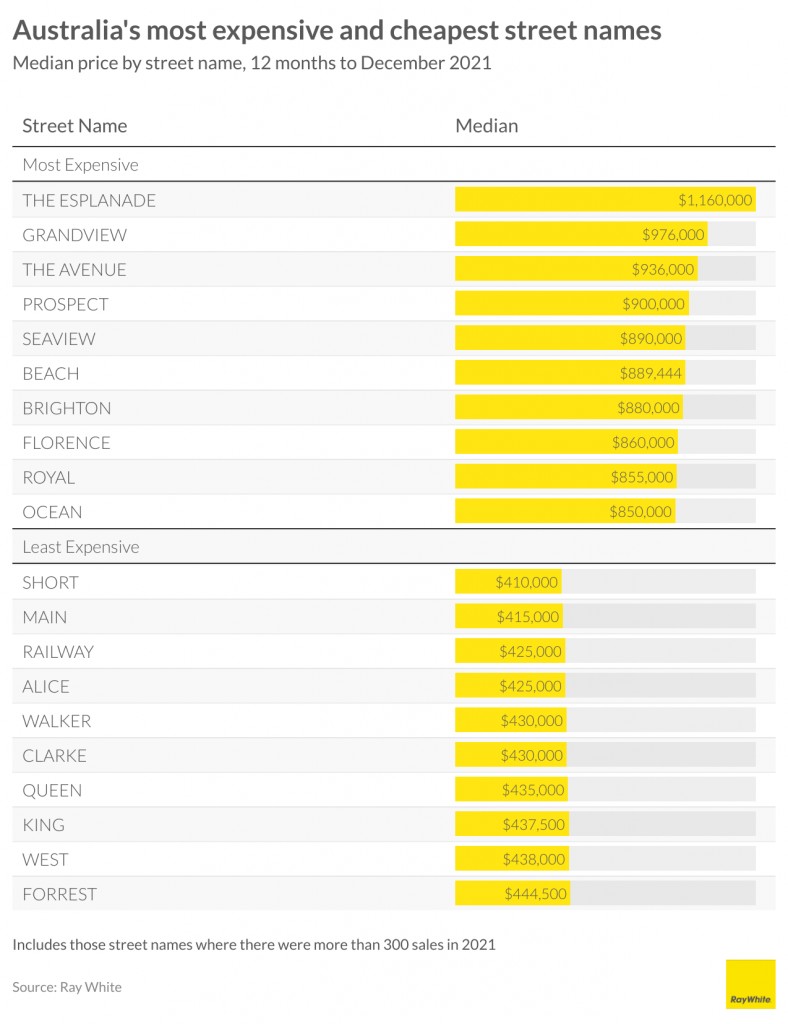

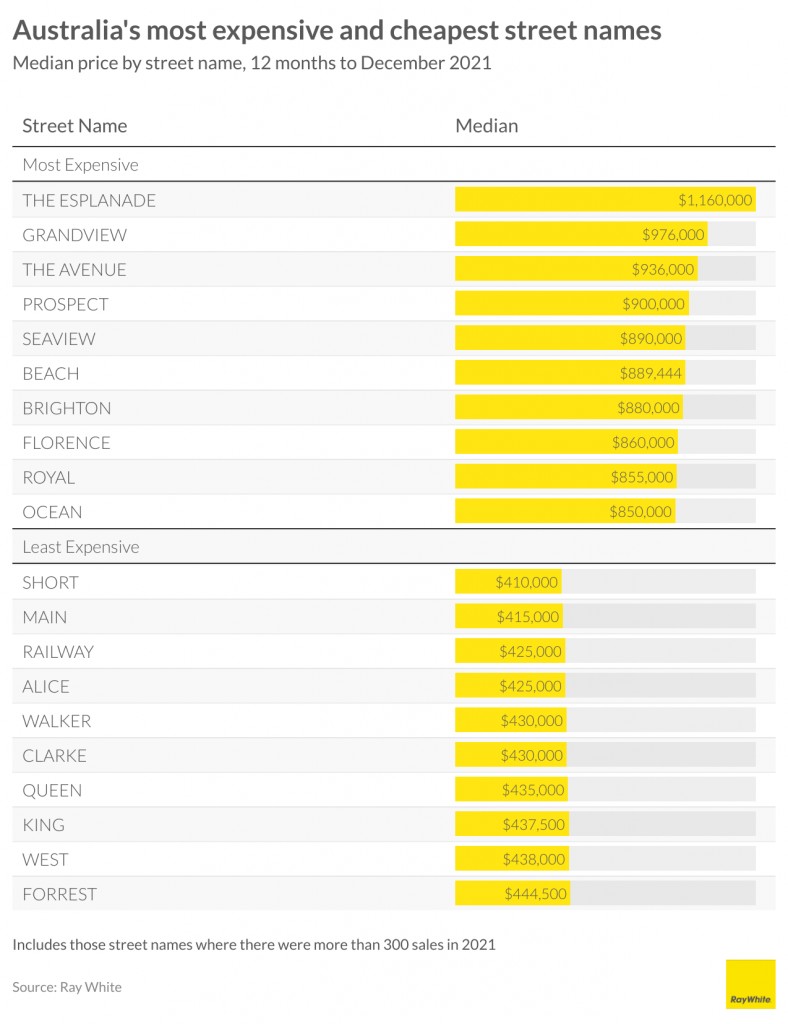

This week I looked at street names to see which ones were priced on average far higher than the Australian median, and those that are far below.

What’s in a name? Some street names command higher prices than others

Some street names just sound expensive. If you are living on Grandview, you would assume, rightly as it turns out, that your home is more expensive than if you were living on Main Road. Like a game of Monopoly, it turns out that some street names command a higher price than others. This week we take a look at the street names that have resulted in the highest median over the past twelve months, and those that are lowest.

Adding the word “the” to a street name seems to be one sure way to raise the median price. Looking at the top 10 most expensive street names, The Esplanade and The Avenue both make the list. The promise of a view is also a way to get prices up – Grandview and Seaview provide on average around a 60 percent premium to Australia’s median house price.

Australia’s love of the beach comes up in Beach and Ocean making the top list. Conversely, while a nearby train line or a major road network is convenient, living on Railway Road pushes down the median. Similarly, Main Road is also on the most affordable list.

Royalty can go either way. Living on Royal Avenue commands a premium but King Road or Queen Street pushes it down. It perhaps shows that even by using a royal word as a street name doesn’t necessarily guarantee a push up in pricing

Finally, women’s names show a distinct difference between more flowery names compared to those that are more practical. Florence Street gives a premium to the Australian median of 40 percent, while Alice Street is 30 percent below.

Source: Ray White Now