This week we take a look at whether house prices double every ten years, as well as how market dynamics are changing as we get to the end of the year.

Do house prices double every 10 years?

Property is seen as a worthwhile investment for a number of reasons but for most people that buy residential property, capital growth is a major driver. With rental yields frequently low, the opportunity to take advantage of leverage can lead to significant profit when buying.

As a rule of thumb, it is often said that property prices double every ten years. If this is the case, affordability challenges are going to escalate over the next decade, particularly given how much prices have gone up since the start of the pandemic.

So do house prices double every ten years? The answer is it depends on when you bought and also where your property is located.

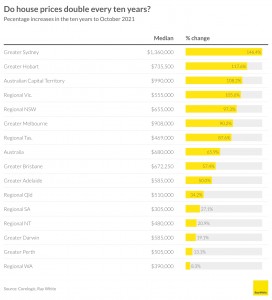

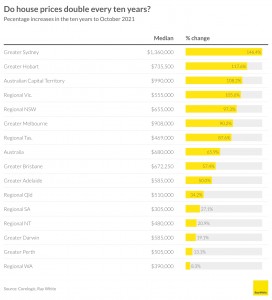

Over the past decade, the only regions where prices have more than doubled are in Sydney, Hobart, Canberra and Regional Victoria. Everywhere else, prices have increased but not doubled. The area seeing the lowest level of growth has been regional Western Australia – ten years ago, this area was in the midst of a mining boom and hence prices were very high. During the past decade, prices dropped a lot and then picked up again with an end result where they haven’t changed much since then.

The timing of when you buy is also important. Looking historically at the regions where prices most frequently double over a ten year period surprisingly shows Regional WA. A closer look at the data shows that up until 2005, you were almost guaranteed to double your money over ten years buying here but after then, there have been no months at which prices doubled compared to ten years prior. Sydney shows much more consistency. If you bought in this city between 2001 and 2007, your property’s value wouldn’t have doubled within ten years but beyond that, it was much harder to find such time periods.

Will house prices double over the next decade? From today, it is unlikely. Typically we find that pricing tends to surge, then stabilise. Occasionally prices also decline. If you bought at the start of the pandemic, it is likely that what you paid for the property will more than double. What is important however is to acknowledge that it is very hard to predict property cycles over the long term. Which means that you should always stick to a budget and aim to hold the property long term. This will minimise the risk of being caught out in a falling market.

The December switch – from red hot market for price growth to red hot for buying opportunities

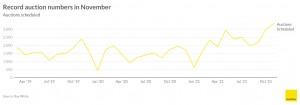

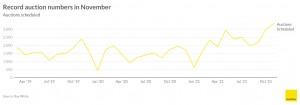

This year has certainly been the year of the vendor with prices rising wherever you look around Australia. It is therefore good news for buyers that the number of auctions scheduled by Ray White Group hit a record high in November with December also sizing up to be an active month. This increase will give buyers many more options when looking for property. December is sizing up to be a red hot market for buying opportunities.

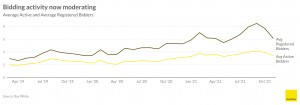

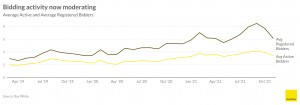

While demand has well and truly exceeded the supply of property since the end of last year, it does look like we are finally seeing this balance out. With more properties for sale, the average number of active bidders has pushed down. While this may seem like evidence of fewer bidders overall, it is certainly not the case. We have seen a big increase in the total number of active bidders. Total active bidders in November was just over 11,500 across Australia, only slightly lower than the highest level recorded in October of 11,650. It is double what we were seeing in November last year. Demand as measured by people actively bidding at auction isn’t moderating, it is just being satisfied by more stock.

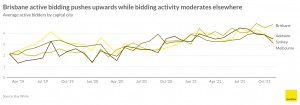

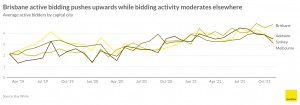

More stock on market will lead to greater stability in prices which have been rocketing up. The extent of the slowdown however will depend on where you are. In Sydney, Melbourne and Adelaide, average active bidding declined in November. This was not the case in Brisbane where it pushed up to the highest level ever recorded. Not a bad achievement given it was also the month that we saw the most properties going to auctions ever recorded. Right now it is looking like a new year slow down in price growth for most places but Brisbane may be set to see quite different conditions to the rest of the country.

Source: Ray White Now