Green energy will require more of Australia’s mineral resources – here are the areas set to benefit.

Green energy doesn’t require coal or oil but it does require a lot of other minerals. If the world embarks on a course to become carbon-neutral by 2050, that will mean high demand from minerals such as cobalt, copper and nickel. Electric vehicles do not run on petrol but do require six times the mineral inputs of a conventional car, while an onshore wind plant requires nine times more mineral resources than a gas-fired plant.

Australia is not just a major producer of coal, gas and iron ore but is also rich in minerals required for green energy. We are in fact the biggest producer of lithium in the world, accounting for 50 per cent of production by value, the second largest producer of aluminium and the third largest of cobalt. We are well equipped to benefit from the transition to other forms of energy.

The impact on property is long term and as yet, still hard to quantify. But as we have seen with iron ore in Western Australia, a rise in demand for our minerals not only benefits local economies in which the mines are located but also the wider economy. For housing, the direct impact is that more housing is required in surrounding towns but the wealth impacts then spread wider. So much so that the performance of the Perth real estate market is more closely linked to iron ore prices, which is quite different to east coast markets which are far more sensitive to interest rates.

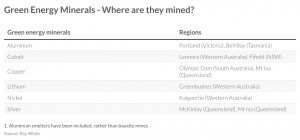

The areas in which many green energy minerals are located does give us some idea as to the locations that might benefit. Most copper is produced at Olympic Dam in South Australia and Mt Isa in Queensland. Almost all of Australia’s lithium is located near Greenbushes, 250kms from Perth.

Other states are also set to benefit. Portland in Victoria produces the most aluminium in Australia. Fifield in NSW is close to one of the world’s largest deposits of high grade nickel, cobalt and scandium. The Central West of NSW is considered so significant by the NSW Government that they have designated it Australia’s first “critical minerals hub”.

In the same way high demand for iron ore led to strong growth in mining towns in places like Port Hedland and Karratha, for areas rich in minerals required for green energy, it is likely that there will be much higher demand for housing and hence a resetting of pricing.

Source: Ray White Now