Nerida Conisbee

Ray White Chief Economist

In this week’s economic update, I take a look at the influence that our booming agricultural sector and the return of expats is having on our property markets.

The shift to regional Australia isn’t just about lifestyle, it’s also about beef and wheat

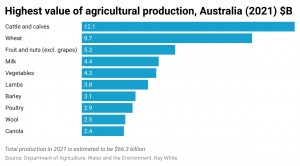

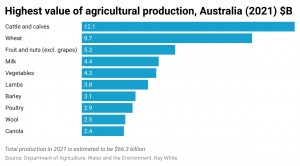

In 2021, Australia will hit record agricultural production this year at $66.3 billion, driven by good weather conditions and strong demand for Australian products. The two biggest contributors to this record result are beef and wheat, contributing almost a third of the total. For property, this is flowing on to strong prices for farms, as well as growth in regional towns.

The shift to regional Australia, and the subsequent uptick in prices for many lifestyle towns, has now been well documented. Although this has been a major contributor, mining and agriculture have also played a major role. A doubling of iron ore exports has pushed up prices in isolated towns such as South Hedland and Newman. Orange, a town in western NSW, has seen strong demand, partly driven by a lifestyle shift, but likely more so by very strong demand for gold. This metal contributes almost 25 per cent to economic growth in this region.

Like iron ore and gold, pricing for Australian beef has also soared. The EYCI (Eastern States Young Cattle Indicator) continues to set new records and is now back over 1000 c/kg cwt

It is being driven by ongoing high demand, low livestock numbers, good export prices and strong supermarket demand. Supply is also declining as herd rebuilding continues, further pushing up values.

Wheat is also having a record year. Chicago wheat futures traded above $7 per bushel in August, hovering around their highest level since mid-May, on expectations of lower world harvests and strong demand. The next 12 months are expected to be good for Australian wheat production and exports – we are the only country with significant upside. Drought has had a particularly negative impact on US wheat production, with almost all of it being turned to hay. Russian production has increased but there are quality issues.

Farmland values continue to increase. The most recent data from Ruralbank up to 2020 show a 12.9 per cent increase in the median price per hectare for rural properties, the seventh year this metric has increased. This growth is expected to continue. There continues to be strong demand for Australian farms, from both offshore and local buyers. Fewer transactions are also taking place due to consolidation of parcels and longer holding times. In regional towns, strong agricultural conditions are leading to big increases in house prices. In the Western Australian wheat belt, the region in which the most wheat is produced, towns like Merredin are rivalling Byron Bay for percentage house price growth. The Queensland outback is benefiting not just from mining but also strong demand for Australian beef. Longreach in particular has seen strong price growth.

Farmland values continue to increase. The most recent data from Ruralbank up to 2020 show a 12.9 per cent increase in the median price per hectare for rural properties, the seventh year this metric has increased. This growth is expected to continue. There continues to be strong demand for Australian farms, from both offshore and local buyers. Fewer transactions are also taking place due to consolidation of parcels and longer holding times. In regional towns, strong agricultural conditions are leading to big increases in house prices. In the Western Australian wheat belt, the region in which the most wheat is produced, towns like Merredin are rivalling Byron Bay for percentage house price growth. The Queensland outback is benefiting not just from mining but also strong demand for Australian beef. Longreach in particular has seen strong price growth.

Are wealthy expats returning? If so, where are they going?

In the June quarter, 59,380 Australian residents returned to Australia. And although there is a lot of discussion about expats returning, 85 per cent of them were back only temporarily to visit friends and relatives. The remaining 15 per cent back permanently were mainly from New Zealand, driven by the more relaxed restrictions with travel to Australia. With most Australians returning here for just a short time period, and most of them from New Zealand, the expat market for Australia’s premium property is likely to be relatively small. But anecdotally, it does appear to be making an impact on some of our more expensive suburbs. It is also likely being driven by expats not quite ready to return but keen to park their money in Australia’s surging property market.

One observation about wealthy returning expats is that many of them own apartments in nice suburbs, having bought them when they were young and prior to heading overseas. On returning, many of them are selling them to upgrade to a big family home in the same suburb. This is leading to price falls for units in these suburbs, but big increases in house prices. If this is true, the suburbs our expats are choosing are possibly returning to places like Kirribilli, Dover Heights and Vaucluse in Sydney and Toorak and Brighton in Melbourne. All of these suburbs have seen big jumps in house prices but apartment prices have declined.

One observation about wealthy returning expats is that many of them own apartments in nice suburbs, having bought them when they were young and prior to heading overseas. On returning, many of them are selling them to upgrade to a big family home in the same suburb. This is leading to price falls for units in these suburbs, but big increases in house prices. If this is true, the suburbs our expats are choosing are possibly returning to places like Kirribilli, Dover Heights and Vaucluse in Sydney and Toorak and Brighton in Melbourne. All of these suburbs have seen big jumps in house prices but apartment prices have declined.

Source: Raywhite.com