Nerida Conisbee

Ray White Group

Chief Economist

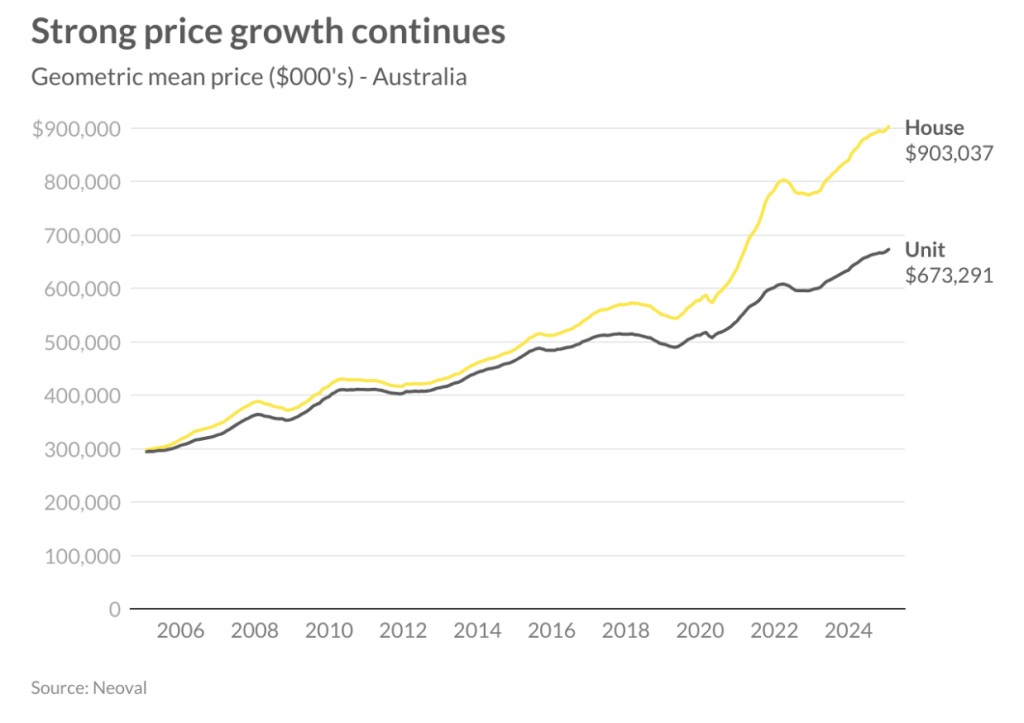

Australia’s housing market has staged a remarkable recovery in January 2025, bouncing back to growth after just one month of price declines. This swift reversal could potentially rank among the shortest market downturns on record.

The resurgence appears to be driven by several key factors. Most significantly, growing expectations of an interest rate cut have boosted market sentiment. This anticipated monetary easing would increase buyers’ borrowing capacity and reduce mortgage payments for existing homeowners. Market confidence has also been bolstered by these positive rate expectations.

Additionally, a seasonal reduction in new listings, combined with more cautious seller behavior, has created tighter market conditions. Once interest rates do decrease, we could see a rapid shift from the buyer’s market experienced in late 2024 to conditions favoring sellers.

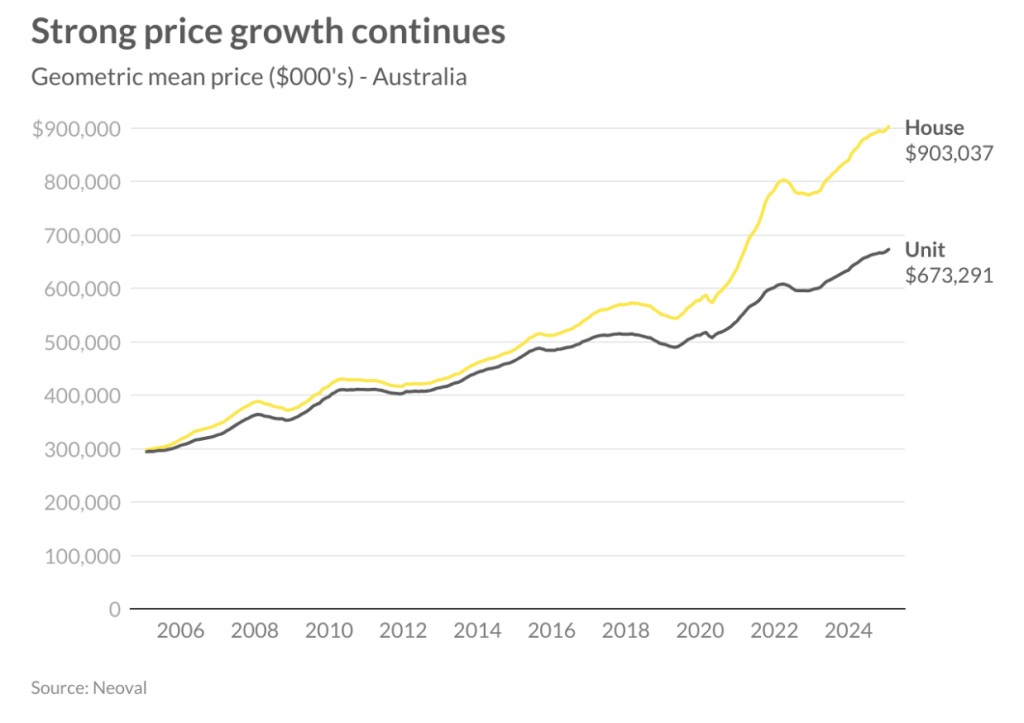

For those hoping for more affordable housing, the outlook long term suggests continued price growth, albeit with occasional brief periods of decline. This trajectory is primarily driven by a persistent structural undersupply in the Australian housing market. We appear to be experiencing a fundamental shift in the property market’s dynamics, where traditional cycles of significant ups and downs are being replaced by sustained long-term price growth, interrupted only by brief corrections.

The supply constraints facing the market are multifaceted and deeply entrenched. The construction industry is operating at capacity, while decades of undersupply have created a significant construction backlog. This is compounded by a fundamental mismatch between available housing stock and shrinking household sizes. Construction timeframes have permanently extended, and the industry faces workforce challenges with an aging labor pool that isn’t being replenished quickly enough.

These structural constraints effectively create a floor for housing prices and limit the potential for significant price reductions. The supply-side challenges represent a complex, long-term issue with no immediate solutions, suggesting sustained upward pressure on housing prices for the foreseeable future. This new pattern of persistent growth punctuated by brief corrections appears to be the new normal for Australian property markets.

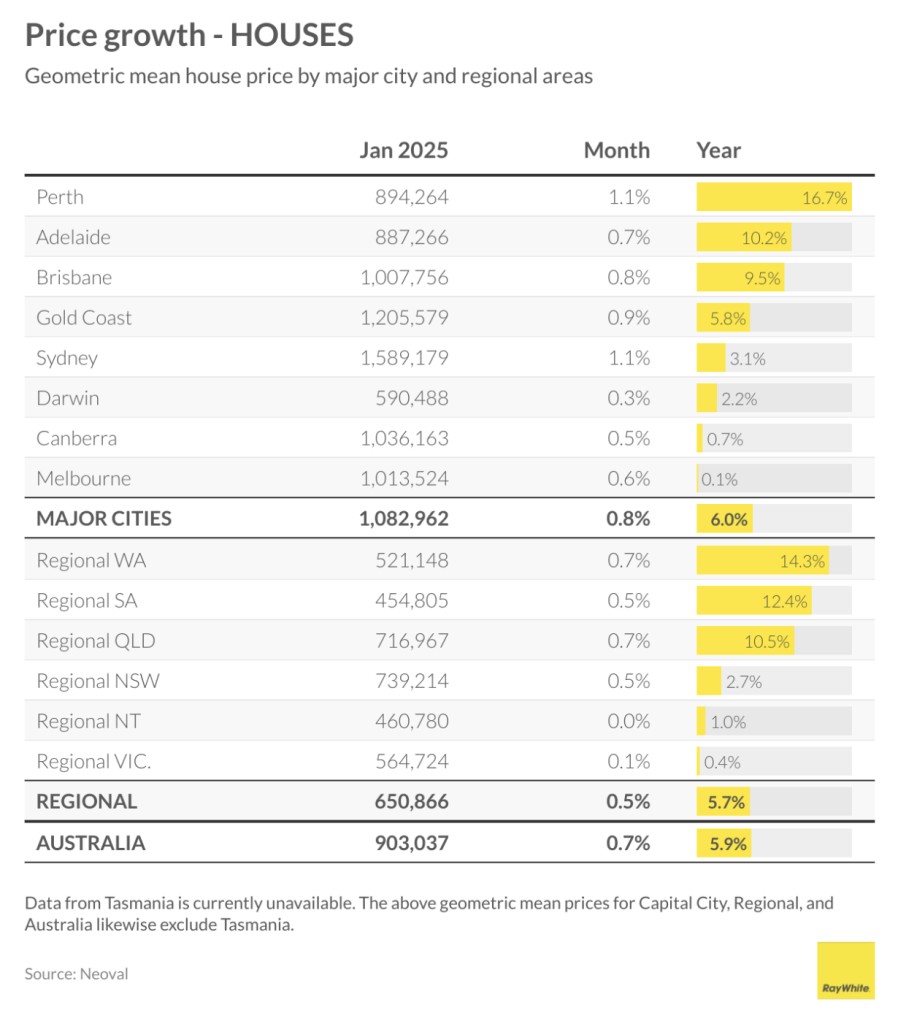

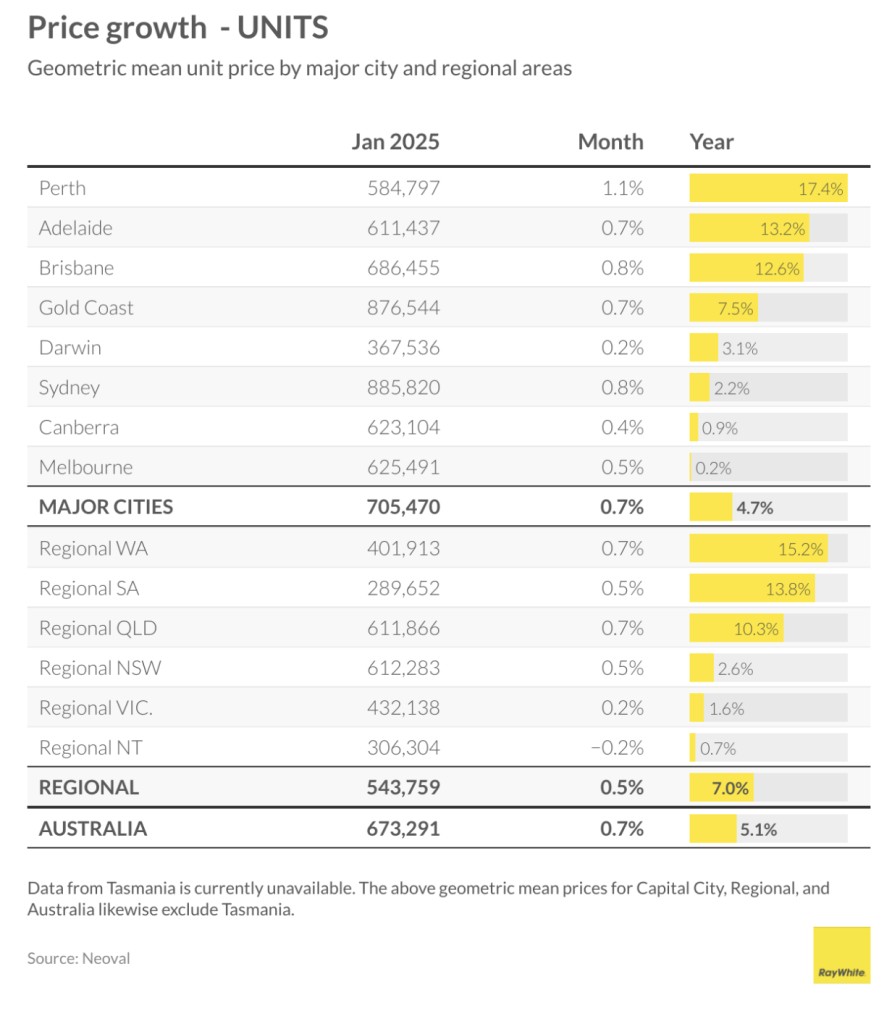

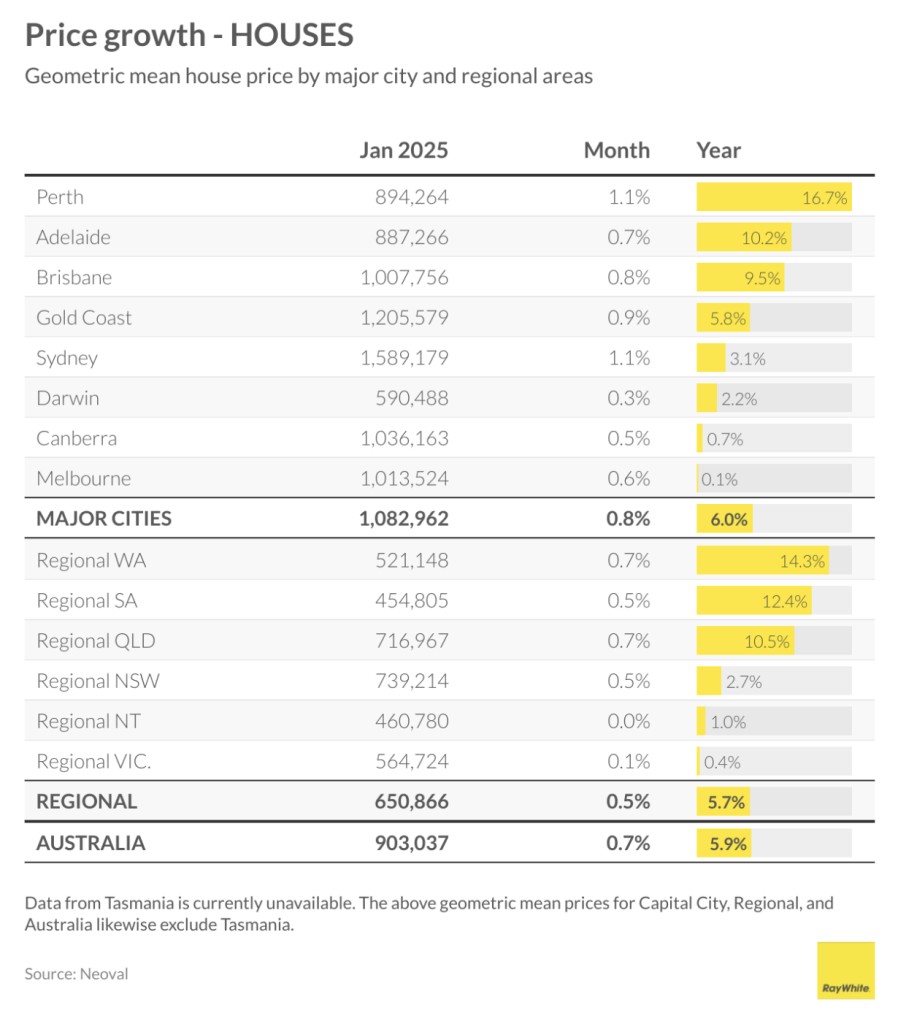

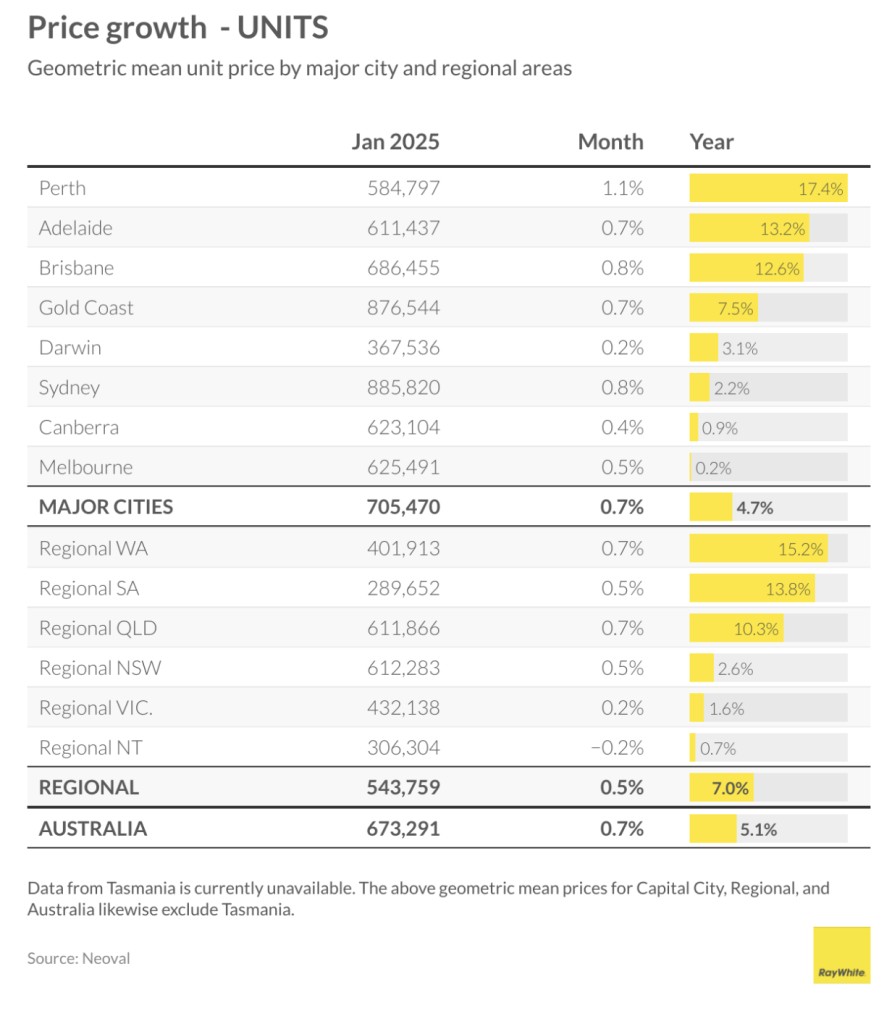

The two-speed nature of Australia’s property market continues to be evident in the latest figures. While Perth maintains strong momentum with 16.7 per cent annual growth and Adelaide shows robust performance at 10.2 per cent, the larger southern capitals remain in a slower growth pattern. Melbourne’s mere 0.1 per cent annual growth, Canberra’s 0.7 per cent, and Sydney’s 3.1 per cent reflect this ongoing divergence.

This pattern extends into regional markets, where regional Western Australia and South Australia continue their strong performance with 14.3 per cent and 12.4 per cent growth respectively, while regional Victoria maintains minimal growth at 0.4 per cent. These figures reinforce that the traditional property powerhouses of Sydney, Melbourne, and Canberra continue to operate at a different pace from the rest of the country.