The hold is disappointing but reflects the relative strength of our economy, particularly compared to much of the rest of the world which has now cut, in some places several times. Conditions aren’t exactly firing but we are not in recession, employment growth is ok, retail trade is growing, unemployment is staying relatively low.

Another reason given for the hold is a recognition that inflation has in part been pushed lower by the National Energy Bill Relief program where each household has been given $300 off their electricity bill. This has reduced inflation on electricity, a key component of increases this cycle. While I don’t agree this should be a major reason – inflation is manipulated up and down by a lot of government initiatives, the other reality is that the outlook for 2025 is now looking a lot more difficult to predict.

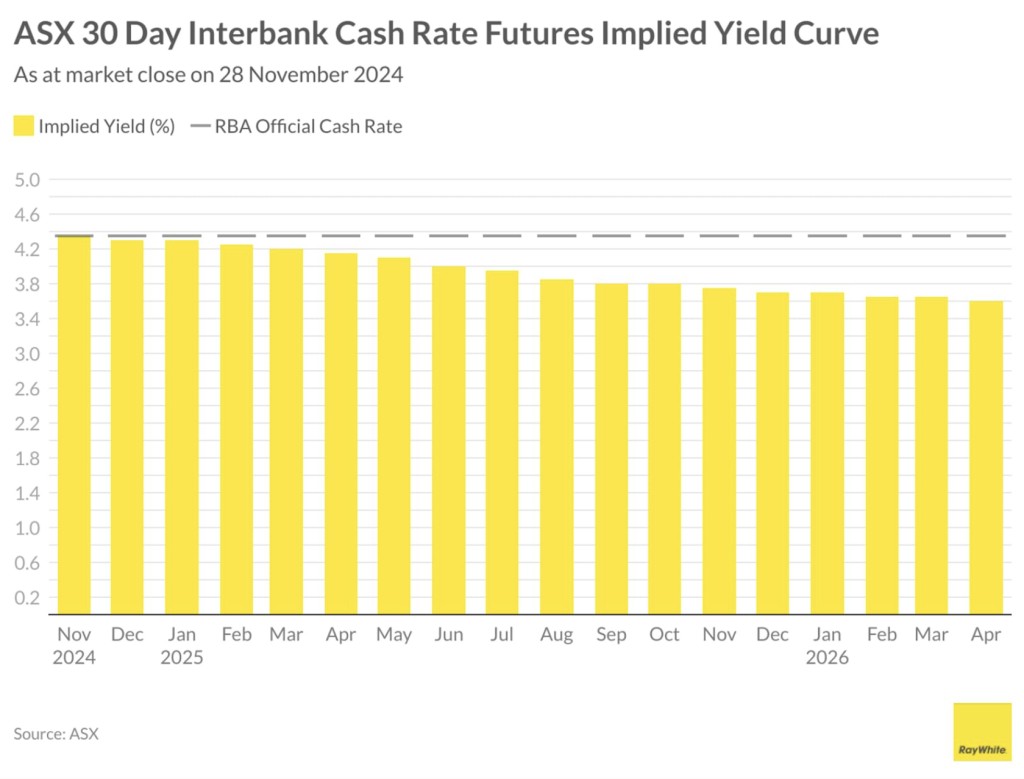

Up until a few weeks ago, markets were predicting four rate cuts for 2025. Now they are predicting two with the first to come in around May and the second in September. The main driver of this has been the election of Trump in the US and the potential for widespread economic challenges in the US, and by extension, for us.

While the US is not one of our major trading partners, China is. Trump has proposed up to 60 per cent tariffs on China. The initial impact may be positive for us – for example, an inability to sell products in the US may mean cheaper products for us. However, longer term, the tariffs would lead to a slowing Chinese economy. This has implications for our outlook across a wide range of industries and sectors – from mineral exports to agriculture and education. It also has implications for inflation – the US economy overheating and inflation again spiking in that country from high tariffs for example could lead to a resurgence in inflation for us.

Based on this, the RBA will continue to move cautiously. It’s possible that cuts will be pushed forward to February – a particularly low inflation rate in the December quarter could be a driver, as could weaker employment growth. A decline in GDP would also play a major role.