How do natural disasters impact property markets?

As flooding continues to impact communities from south east Queensland down to Sydney, this week we take a look at the impact of natural disasters on property markets. Ultimately, the impacts differ significantly depending on the damage caused however there is a general timeline as follows:

1. Early months following the disaster

At this point, it is primarily rental markets that are impacted. The damage to housing means that many people are unable to return to their homes. This creates a significant rental housing shortage. In the aftermath of the 2020 bushfires, this rental shortage was particularly widespread given that not only were many homes completely destroyed but damage to regional areas meant that some towns were unsafe to return to.

2. Twelve months following the natural disaster

This is the clean up phase when homes are either being rebuilt or repaired. At this point, there are usually far fewer sales taking place, particularly if owners in the area are well insured and there is significant government support to rebuild the area.

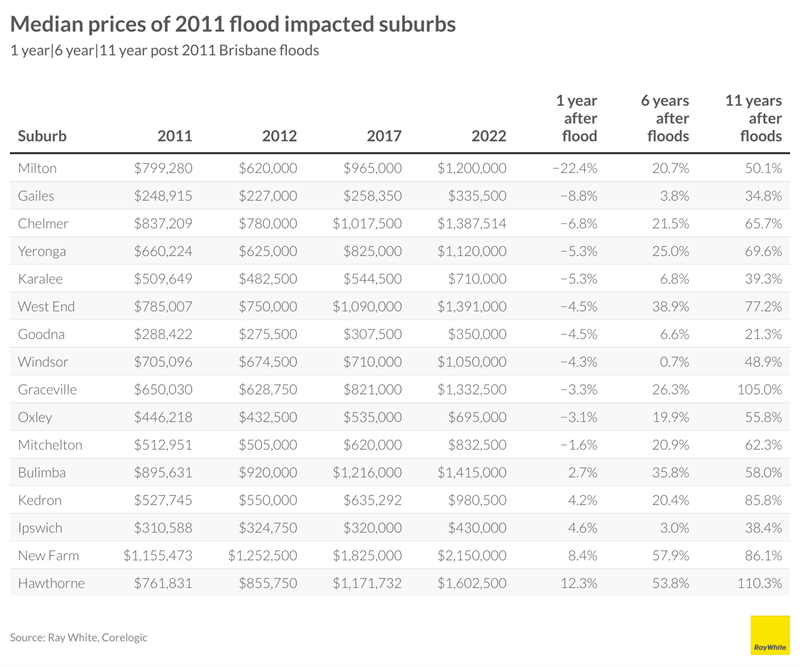

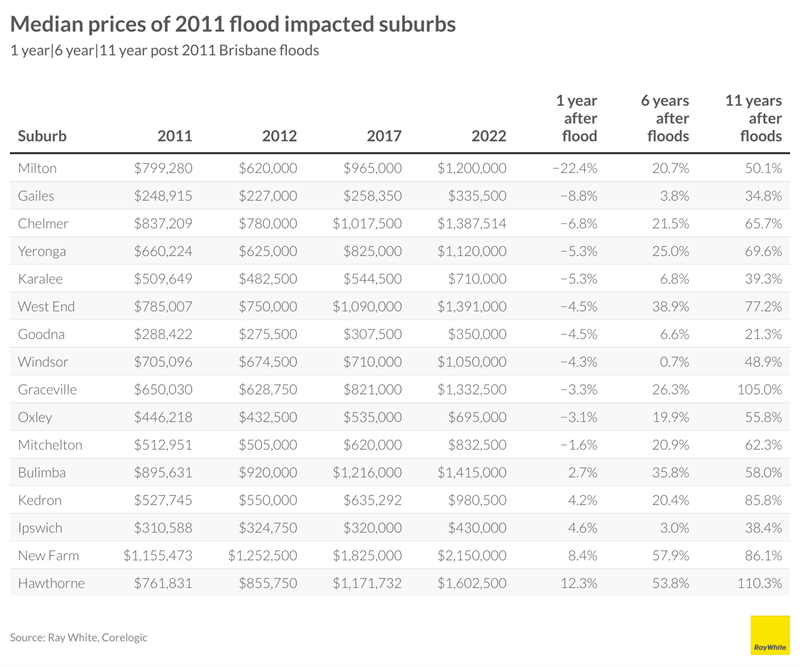

Loss in value can occur during this time as we saw in some suburbs following the 2011 floods in Brisbane. Some of the most impacted suburbs saw a drop in value in the 12 months following. This may have been partly due to a number of homes being under-insured and perhaps concern that the flooding would occur again.

3. Three years following natural disaster

By this point homes have been rebuilt and ideally there will have been significant government spending to minimise the chance of a similar event occurring. Home values typically increase as better and safer homes are built in place of older homes.

4. Six years following natural disaster

Provided the natural disaster hasn’t re-occurred, house price growth is typically following the local market or is being driven by other factors such as population growth. By 2017, all flood impacted suburbs in Brisbane were achieving median prices well above their pre-flood levels.

The price recovery we saw in Brisbane following the floods in 2011 is not unusual for disaster hit areas. Mallacoota, one of the worst hit areas in the 2020 bushfires, now has house prices up 70 per cent compared to where they were three years ago. This is partly due to the timeline outlined above – better and safer homes have been built and there has been significant government spending to try to mitigate another disaster. However, it is also the case that Mallacoota is a beautiful part of regional Victoria where people want to live.

The experience in Mallacoota isn’t unusual. Often places affected by natural disasters are located in highly desirable areas and over the long term, it has a minimal impact on home values. For example, areas close to rivers are prone to flooding, coastal areas are susceptible to erosion and areas in bushland can experience bushfires. Although more dangerous than other suburban areas, living near a river, the beach or in a bush setting is highly desirable for many buyers. This desirability tends to override the greater risk of a natural disaster

The impact on property markets following current flooding will depend on how hard the area was hit. For example, places like Lismore are going to see significant housing shortages while the clean up and rebuild takes place. It is likely that it will take more than 12 months for this community to recover.

In many previously flood impacted areas of Brisbane, this flood hasn’t at this point had the same impact as 2011. This is partly because flooding hasn’t hit as hard but also because it is likely that many homes have been rebuilt to withstand rising water and there has been significant investment in ensuring that flood waters don’t damage properties so significantly.

The following weekend’s auction activity in Brisbane after the flooding also suggested that there wasn’t a big hit in confidence – clearance rates in Brisbane remained elevated and the number of active bidders was particularly high. The number of properties withdrawn from auction however was not surprisingly high – it typically averages around four per cent of the total but that weekend, it increased to 20 per cent.

Source: Ray White Now