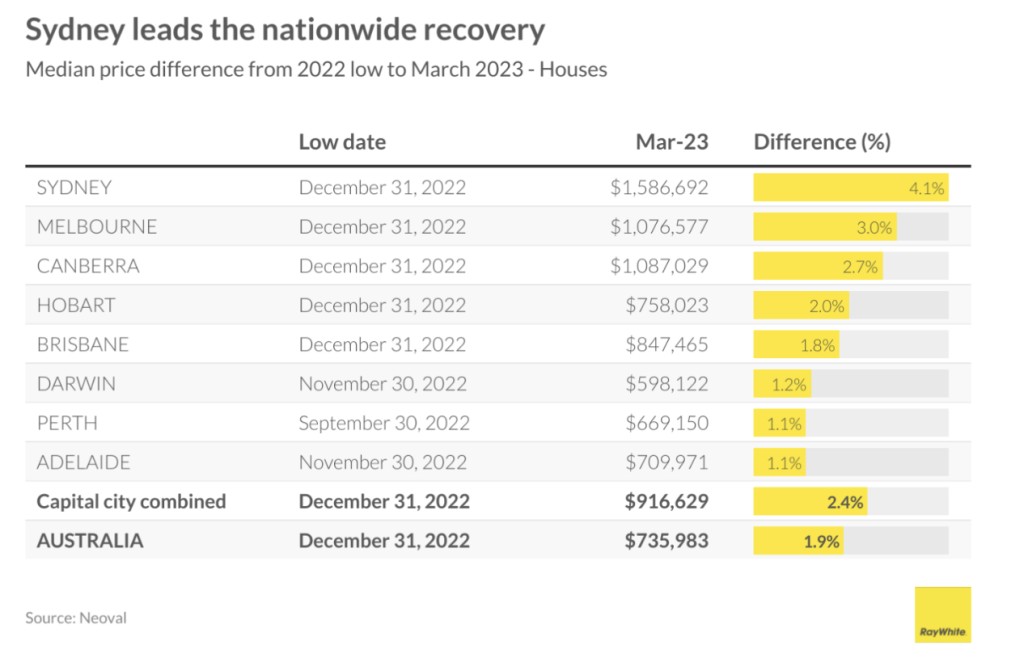

Population growth and a housing shortage are both now outweighing increases in the cost of finance with Australian house prices having increased by another 0.5 per cent in March. Price growth has now been occurring since December consistently across every capital city.

Leading the charge is Sydney with the median up 4.1 per cent since December. In every capital city, prices are now back to where they were mid last year. If the current rate of growth continues, there is the potential for declines seen in 2022 will be completely reversed by the second half of 2023.

While population growth and a housing shortage are the major drivers of price increases right now, it is also likely that we are now at the peak of the interest rate cycle. The RBA is likely to keep rates on hold tomorrow, driven by a greater than expected fall in inflation, as well as growing concerns about a global banking crisis. If we are at peak, this will be further impetus for price growth to continue for the remainder of the year. In places we are seeing the strongest increases in rents, such as south east Queensland, it is possible that price increases will hit double digits over the next 12 months.

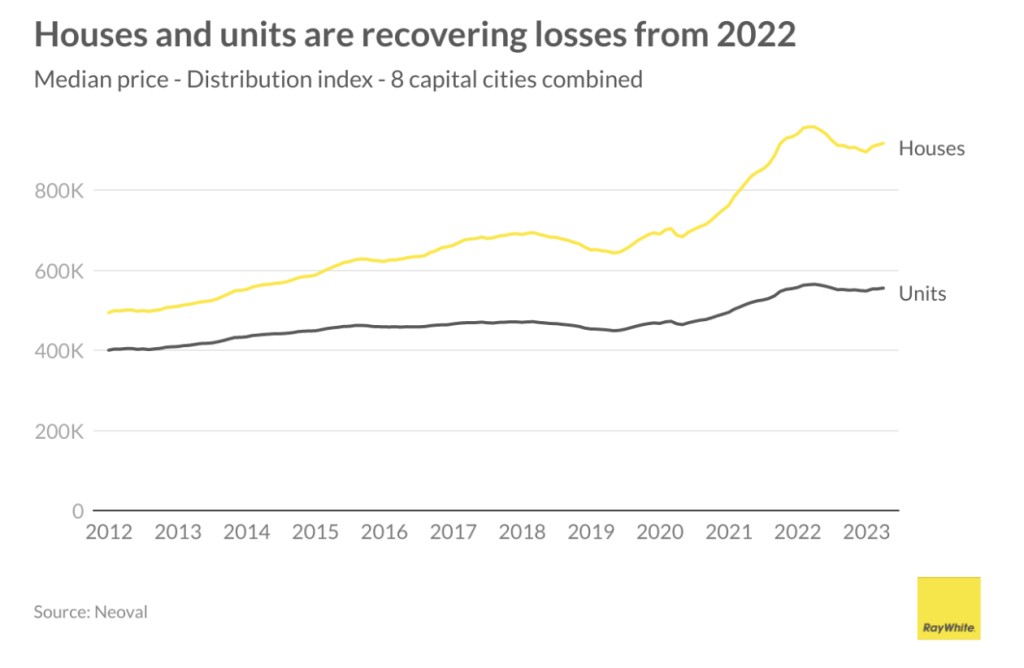

Like every downturn, we have seen prices fall far less than what is generally predicted. Housing markets almost always surprise with strength on the upside and see far less robust declines when the market turns. It is certainly the case this cycle, with peak to trough decline of Australian capital city house prices of 6.5 per cent, compared to COVID-19 driven price growth of 36 per cent.