Nerida Conisbee,

Ray White Group

Chief Economist

An interest rate rise will mean more headaches for renters and mortgage holders.

Interest rates increased today by 0.25 per cent. It won’t help fuel prices or electricity costs, it will prolong the rental crisis, worsen housing supply and further push up house prices. It will squeeze households more and increase cost of living pressures.

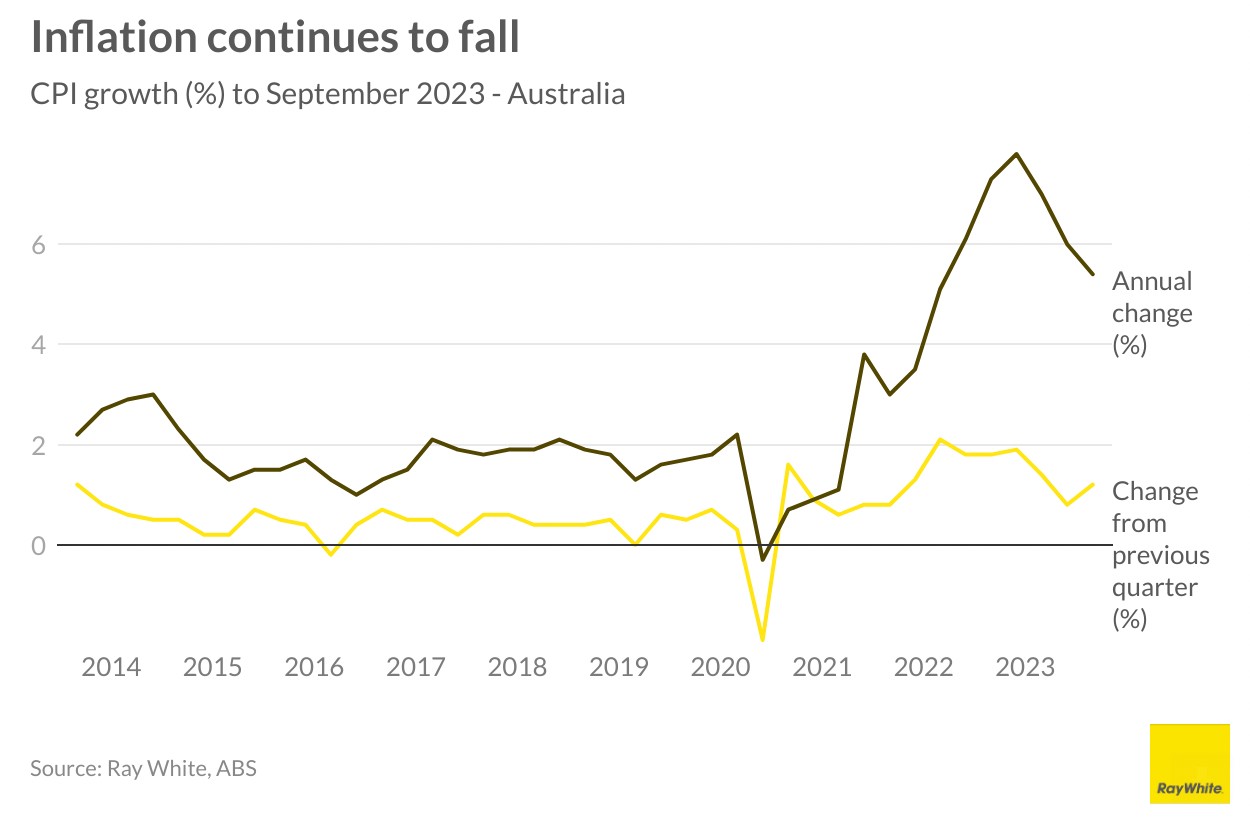

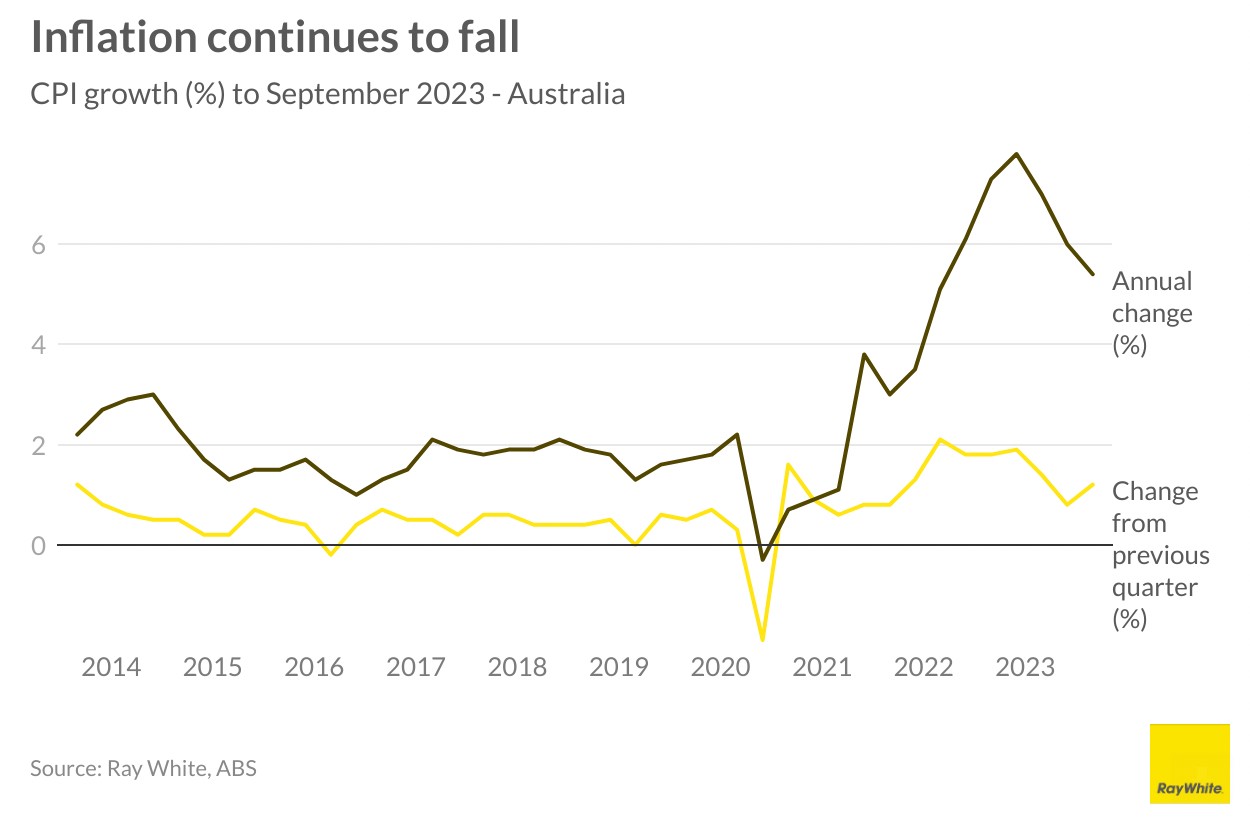

Inflation is still well above the 2-3 per cent band which the Reserve Bank aims for. We did see a reduction in inflation in the September quarter, reducing to 5.4 per cent, much lower than the peak reached in December 2022 at 7.8 per cent. The interest rate rise today was driven by the fact that inflation is coming down but is remaining too high and too sticky.

The main drivers of inflation at the moment are housing costs (rent and construction), electricity and fuel. Fuel prices are being driven upwards by restrictions to production by Russia and Saudi Arabia, as well as the Israel/Hamas conflict – an interest rate rise will have no impact on this. The impact of interest rate increases on electricity costs are also relatively benign.

However, the situation is more problematic for rents. Rents are increasing rapidly as a result of a housing shortage. We are not building enough homes and investors aren’t as active as they need to be to increase the number of rental homes. Interest rate rises are making this worse – fewer homes being built and too few investors are coming into the market. Worse is that it is also reducing the number of rental homes as investors sell and also reduces the pipeline of new stock as developers find it harder to get projects up and running. It is also creating a feedback loop – rents are rising, increasing inflation, this increases interest rates, this in turn leads to even more rent rises, further fueling inflation and even more interest rate rises.

What interest rates can control is already coming back. International travel is now reducing, as is the price of food. Less furniture is being purchased and construction costs are finally slowing. Monetary policy has done the work already in what it can control

Obviously we can’t have continued high inflation and monetary policy is the most straightforward way to slow the economy. Unemployment remains too low and it is still hard to get staff in some industries. For housing however, problems won’t be resolved until rate rises stop.