Nerida Conisbee

Ray White Group

Chief Economist

Despite widespread belief Baby Boomers are primarily responsible for Australia’s housing market woes, the reality is far more complex.

Many young Australians point to this generation’s property wealth as a key factor driving up house prices and reducing affordability. However, a closer look reveals that Baby Boomers themselves are caught in a paradoxical housing situation.

On one hand, they’re the generation most likely to have excess living space, often residing in large family homes with multiple spare bedrooms. They have done well from property, many bought at a time when housing was far more affordable and have most likely paid off their homes. A lot have invested in property which has also increased significantly in price. More negatively, this same generation is experiencing the most rapid increase in homelessness of all generations.

Australia has 13 million spare bedrooms and most of them are in fully owned homes of older Australians. There are limited financial benefits to downsizing. The family home is a tax-free asset and even if it’s required, there are often very few suitable homes available to downsize to. Add to this the emotional attachment to a home that has been owned for a long time and we have a lot of Baby Boomers living in very large homes.

There is no question that property has become far less affordable over time. Baby Boomers paid far less for property relative to their incomes compared to people entering the market now. However, it wasn’t particularly easy for them to get a loan – interest rates were a lot higher and women were often refused mortgages without a male guarantor. Typically, Baby Boomers bought a home as a couple and buying as a single person was less rarely undertaken. Housing is much more expensive now, but lending is far less restrictive.

Data on the number of Baby Boomers that own rental properties is not easily available. ATO data on the number of people making claims for rental properties shows the majority are far younger than Baby Boomers. However, the ATO measurement only includes properties where it’s possible to negatively gear. With many Baby Boomers likely now fully owning rental properties it’s harder to measure how many are owned by them. Regardless, it’s likely that many have done well from investing in property given how significantly prices have risen during their lifetime.

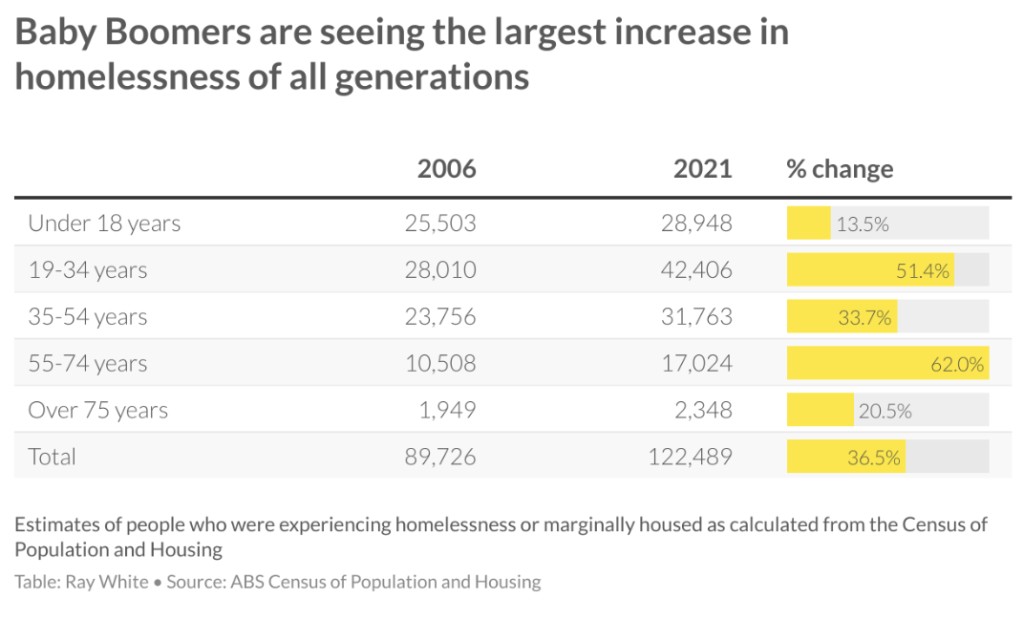

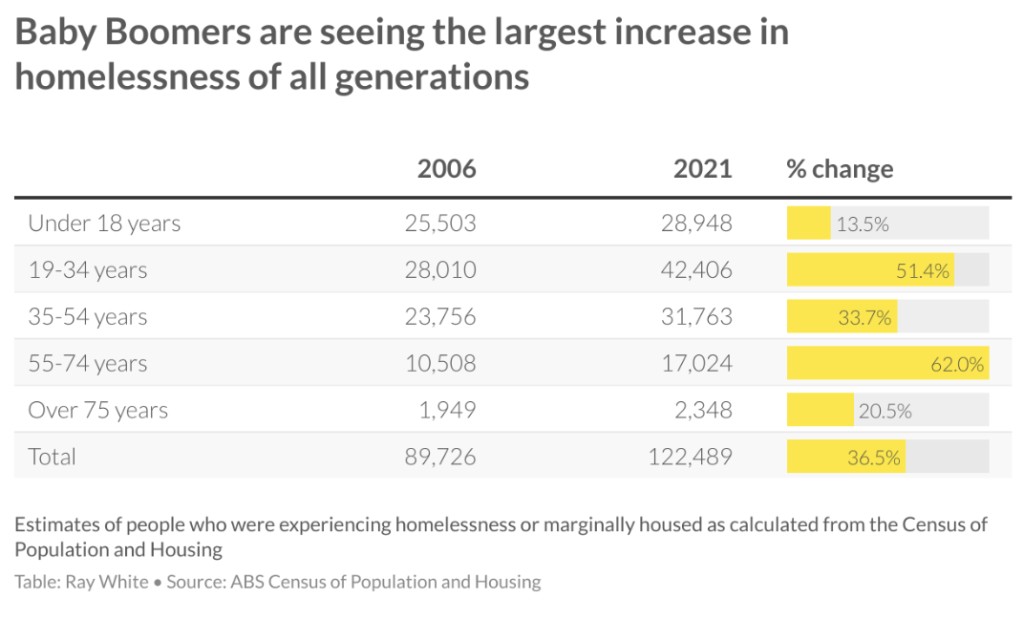

But while Baby Boomers have undoubtedly done the best from housing of all generations, a more worrying statistic is the rapid rise in homelessness amongst this age group. Over the past 15 years, people aged 55 to 74 years have seen a 62 per cent rise in homelessness, the highest of any age group.

Although they aren’t the most likely generation to be homeless, what is challenging about the rise is the stage of life that Baby Boomers are now in. Many are retired, or close to retirement and most have limited ability to increase their incomes. As they age, health issues are emerging making unstable housing more challenging. Divorce and separation can leave individuals financially vulnerable, and this is particularly the case for older women who have had significant time out of the workforce with limited retirement savings. Those who don’t own homes face increasing rents and competition from younger generations in the rental market.

This nuanced situation challenges the simplistic view of Baby Boomers as merely beneficiaries of the housing market. Instead, it reveals a generation grappling with its own set of housing challenges, alongside the broader issues affecting all age groups in the Australian property market.