Nerida Conisbee,

Ray White Group

Chief Economist

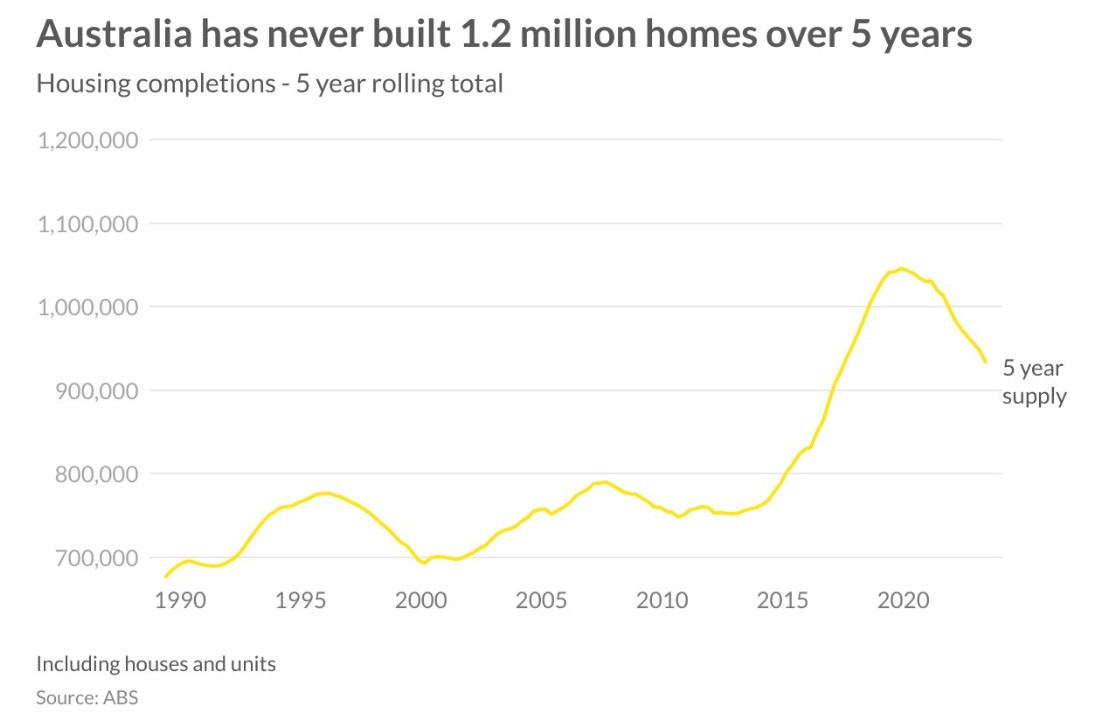

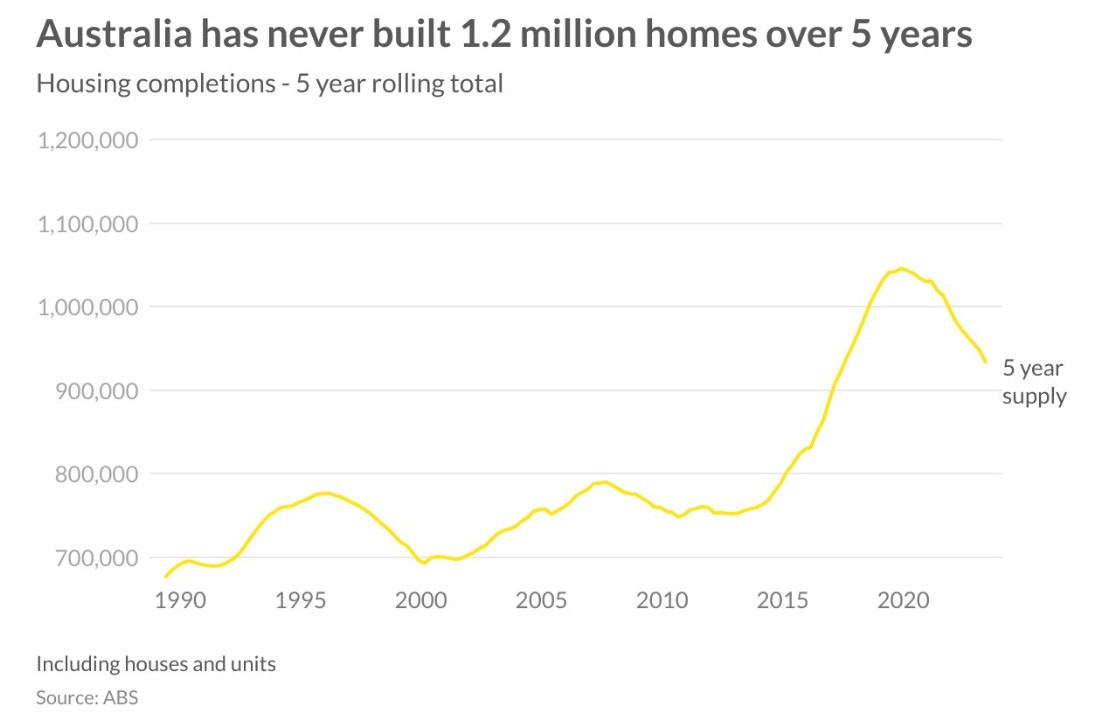

The rental crisis, soaring house prices despite much higher interest rates and being one of the least affordable countries in the world could be solved if we built more homes. For this reason, the Federal Government announced a target of 1.2 million new homes over five years from 2024. We have never built this many homes over a five year period and unfortunately we are already off to a bad start.

The closest Australia got to building 1.2 million homes over five years was from 2015 to 2020 when 1.05 million homes were built. This was a period in which we saw the biggest influx of Chinese capital ever recorded and there were thousands of apartments built across our CBDs and close to universities. The Chinese capital has mostly evaporated and there is nothing as significant to replace it.

The money to develop so many homes has to come from somewhere. We have seen a slight pick up in offshore investment but nothing like we saw last decade. Company owned rental properties (“build to rent”) is a growth area but the pipeline of development from this source remains a tiny proportion of what is required. Superannuation is frequently named as the solution but there remains a disconnect between our superannuation funds being invested in affordable housing and achieving a decent level of return.

Ultimately, most of the money will come from households, whether in the form of people buying homes to live in or to invest in. The problem right now is high interest rates are preventing many from being able to buy new homes. Monetary policy is choking housing supply.

A second challenge is high construction costs. Although the surge in pricing has moderated as building material costs reduce, it will take some time for labour shortages to be eased. Unemployment is still very low and industries like construction are seeing some of the most significant shortages. There are also too few building companies, and again this will take time to resolve.

As well as these two current challenges, there are ongoing issues that have existed for a long time and are why Australia continues to see housing shortages. There continues to be a resistance to densities in our suburbs and this makes it difficult for town planners to get projects approved. Fortunately this is one area that the Government can more easily control and we have seen the announcement of many rezonings across Australia in recent months.

While the goal of 1.2 million homes is impossible to achieve over the next five years, positively, it has been recognised that this is the way to ensure affordability. The role of building enough homes to increase affordability was surprisingly contentious until recently.