Nerida Conisbee

Ray White Group

Chief Economist

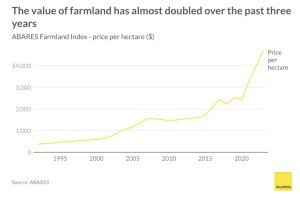

We have never had such good farming conditions as we did in 2022. While particularly good Australian weather conditions were the major driver, so too were poorer conditions elsewhere around the world. We were producing a lot, while others were producing far less. As we came out of the pandemic, people began spending more. The Ukraine conflict further complicated wheat markets. This confluence of factors resulted in total agricultural production exceeding $90 million and land values almost doubling in the past three years. Unfortunately the outlook is more uncertain.

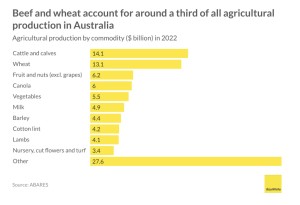

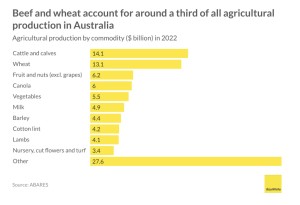

Australia’s two main agricultural products are wheat and beef and these accounted for a third of all production by value last year. Wool, historically important for Australia, now doesn’t even make it into the top 10 commodities by value. Nursery cut flowers and turf became a higher value commodity with $3.4 billion of production in 2022, compared to $3.2 billion for wool.

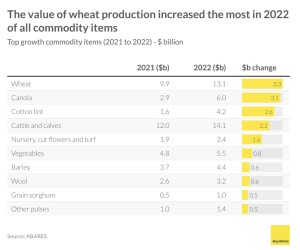

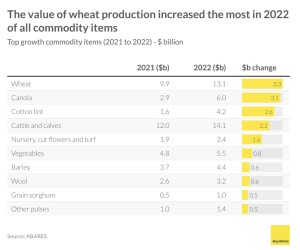

However, the top performer for growth in 2022 was wheat. The total value of wheat production increased by $3.3 billion in 2022, hitting an all time high of $13.1 billion. Canola and cotton lint also saw large increases, more than doubling. This strong performance in wheat had a strong flow on impact to farming communities and farm values. It also resulted in record house price rises in many wheat farming regions.

While last year was a record year, this upcoming year is set to be far less stellar. The Australian Bureau of Agriculture, Fisheries and Forestry (ABARE) has forecast that the value of agricultural production will fall by 14 per cent next year. Dryer conditions across Australia are the main driver, however better production overseas is expected to impact values.

There are also geopolitical issues at play that could make things more positive or negative. Although wheat production is set to fall in Australia as weather conditions deteriorate, wheat prices are expected to rise. Last week, Putin abandoned the Ukrainian wheat deal which ensures safe passage of wheat from that country. A subsequent drone attack on a wheat storage silo in a Ukrainian port city led to global wheat prices rising to their highest level since February.

Rice prices are also expected to rise rapidly with the Indian government last week banning all exports of non-basmati rice to deal with domestic shortages. India produces around a quarter of all rice in the world and is the world’s biggest exporter. This announcement is expected to result in the biggest global rice shortage in 20 years. Similarly to wheat, prices are set to rise. Although Australia is not a major rice producer, it will impact the Riverina in southern NSW where around 75 per cent of Australia’s rice is grown.

While wheat and rice prices are likely to increase, the same is not the case for beef. While it is now our highest value commodity item, cattle prices have halved from where they were in February 2022. Meat and Livestock Australia forecast that prices will continue to fall marginally over the rest of the year. More positively for the total value of beef, the national herd continues to grow and is set to be at its highest level in more than a decade.