Nerida Conisbee,

Ray White Group

Chief Economist

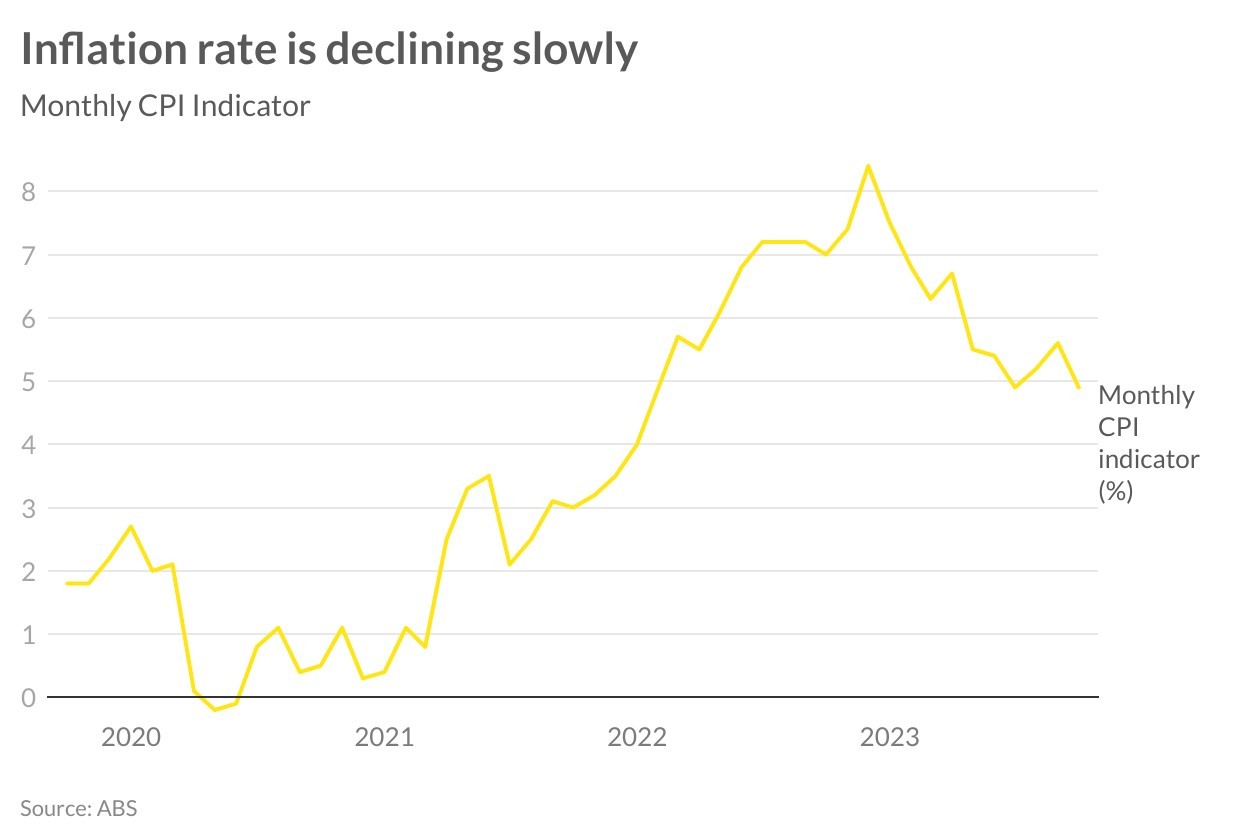

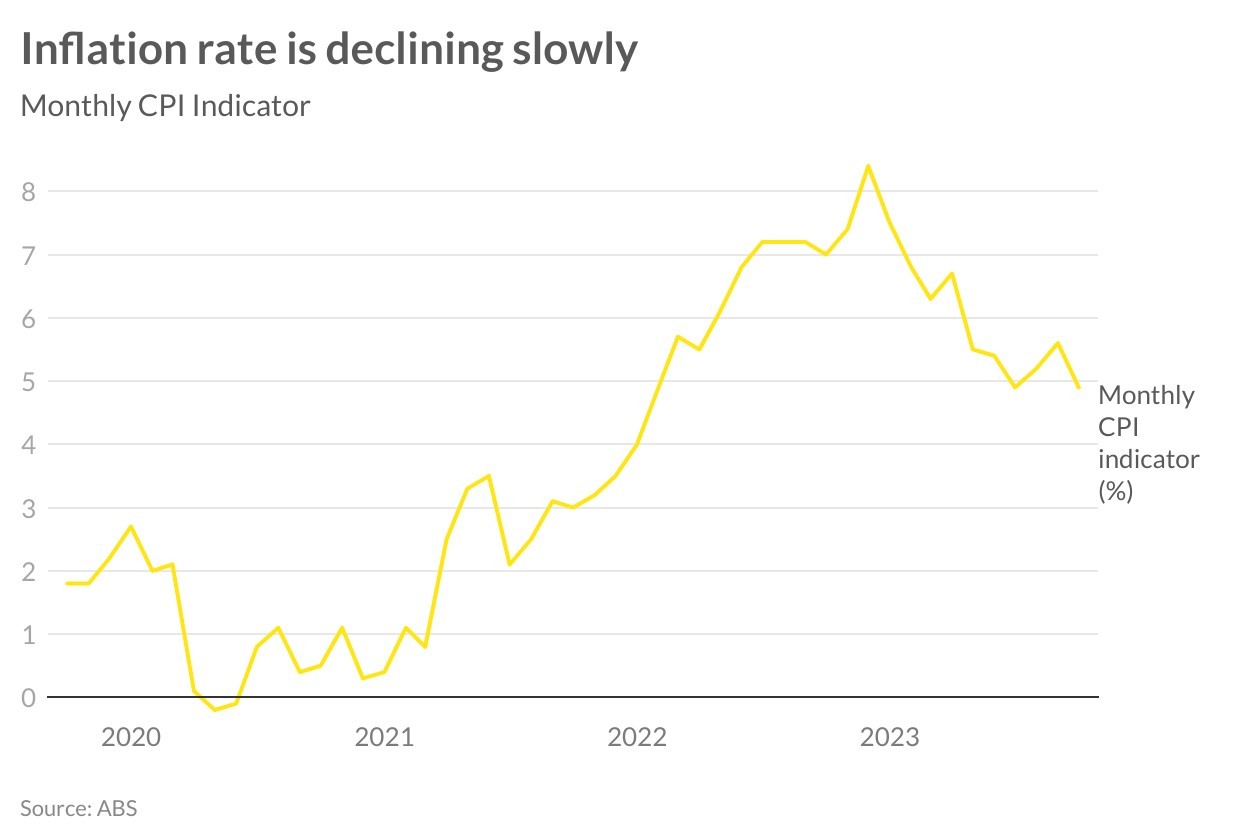

Inflation continued its painfully slow downward trajectory in October, resulting in rates remaining on hold in December. The most significant increase in the inflation basket continues to be housing, in particular rents. While construction increases have slowed considerably, the lack of rental accommodation is driving up inflation.

Housing costs are now up 6.1 per cent over the year. Food is another major driver of inflation, up 5.3 per cent. Automotive fuel is also causing problems, up 8.6 per cent.

Will we see another rate rise? Perhaps. Inflation is coming down but not quickly. Market expectations of where they will peak continue to fluctuate. While the slow decline is not encouraging, there are some positive signs from overseas. In the US, inflation is now down to 3.2 per cent, while Canada sits at 3.1 per cent. Elsewhere, inflation is still too high but the gap between where Central Banks want it and where it sits is narrowing.