Nerida Conisbee

Ray White Group

Chief Economist

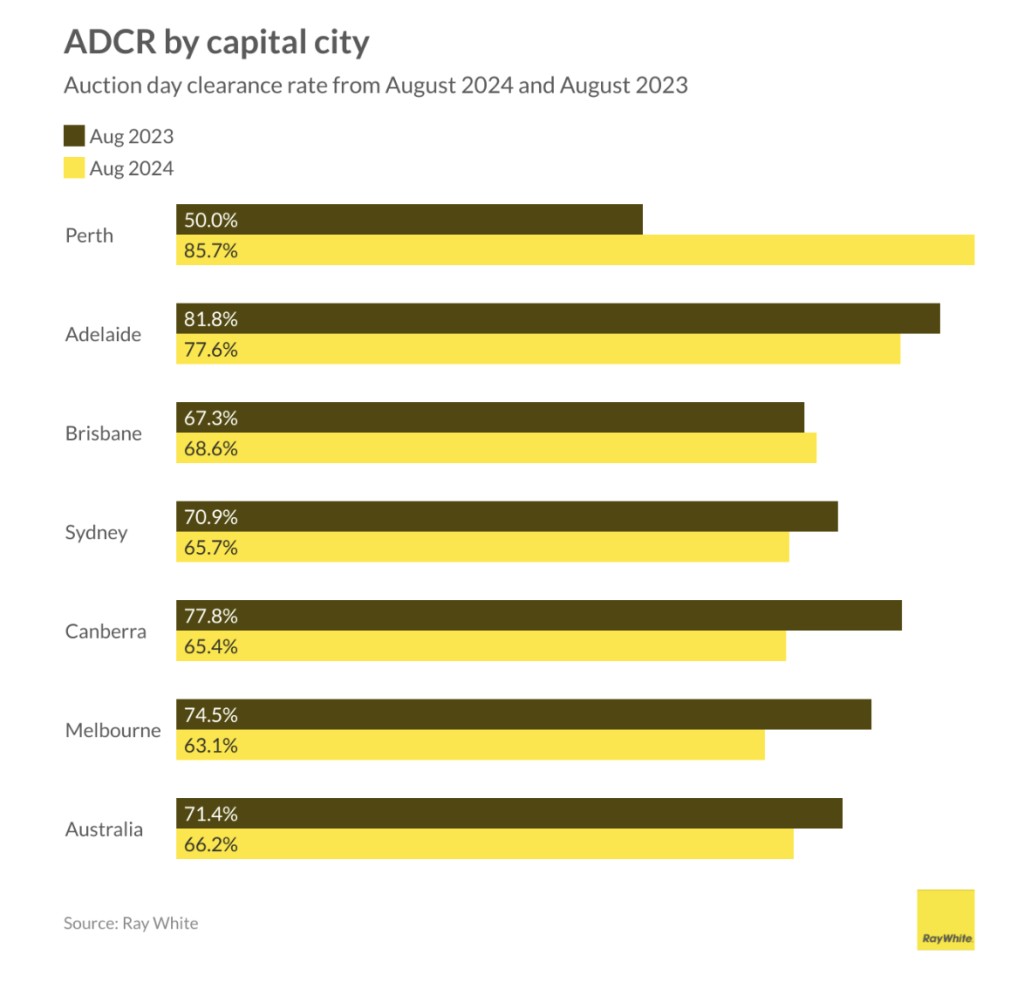

Nationally, auction numbers are up, the number of people actively bidding is falling and this is causing a fall in clearance rates. All of this adds up to a slowing market, and price moderation or even falls.

However, this does ignore that there continues to be wide divergence across capital cities.

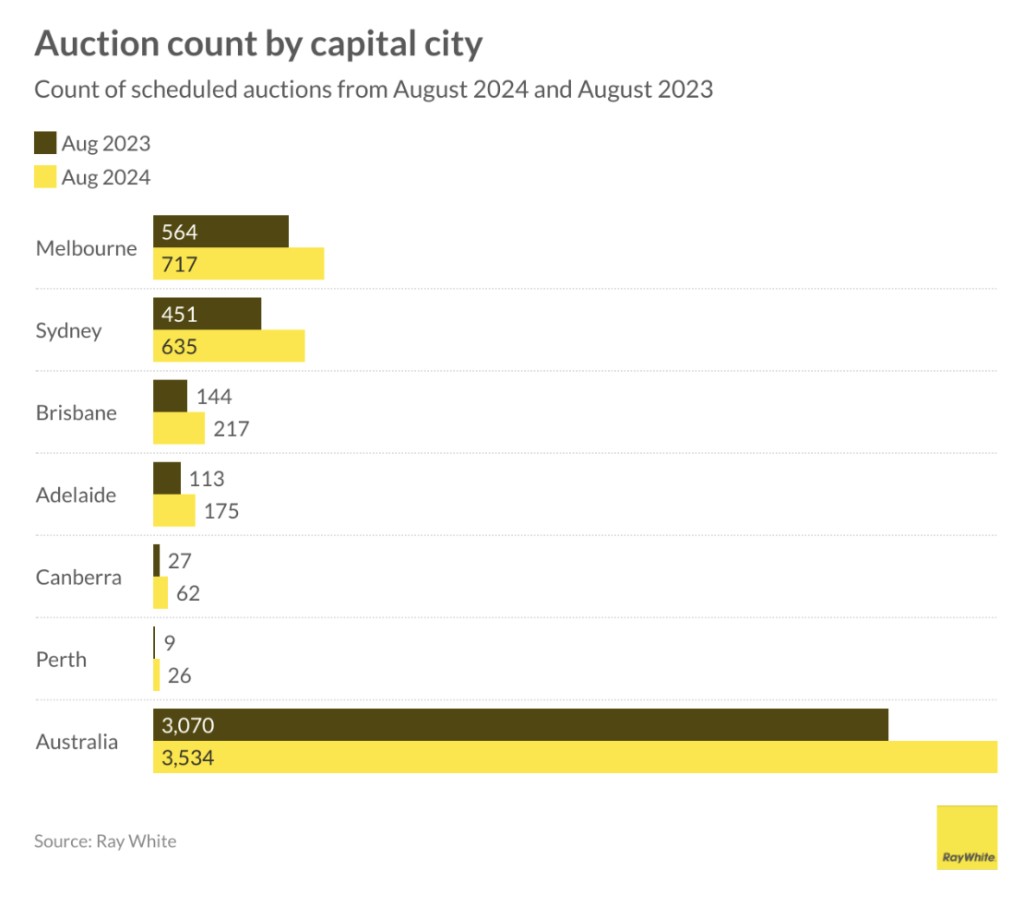

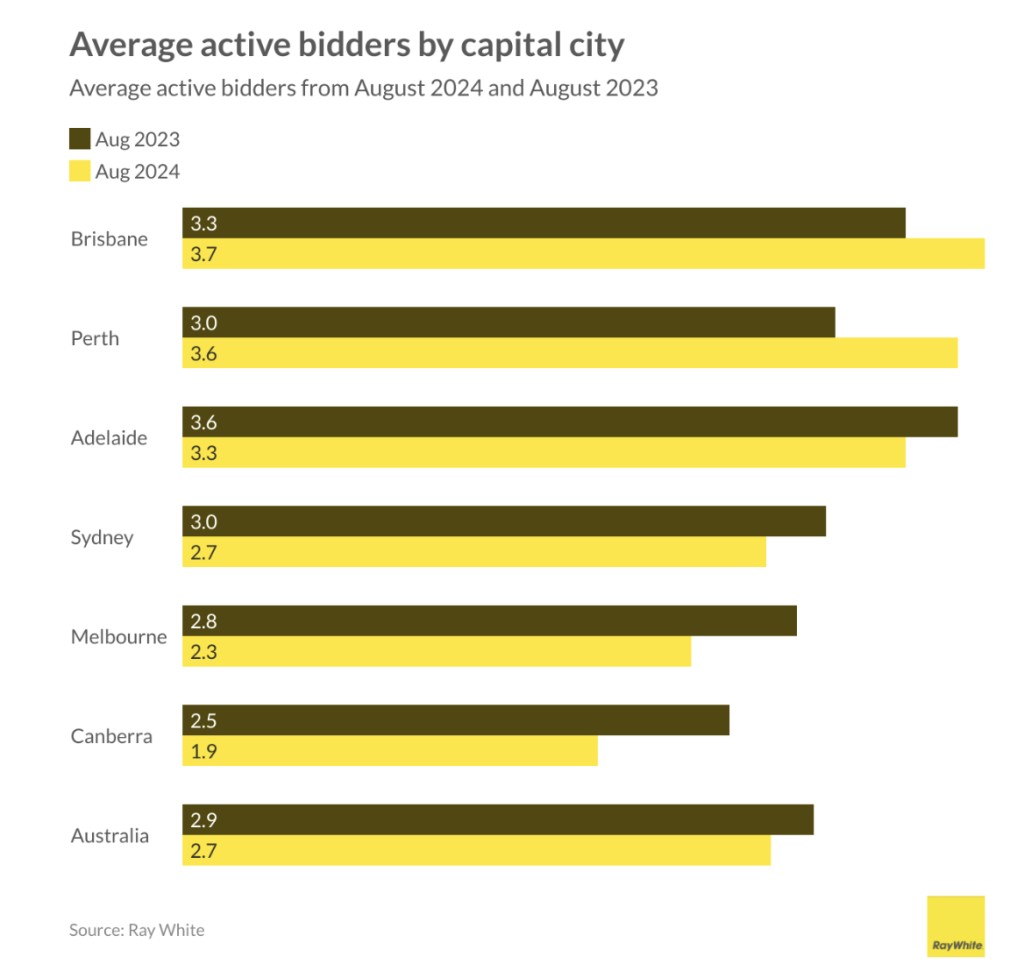

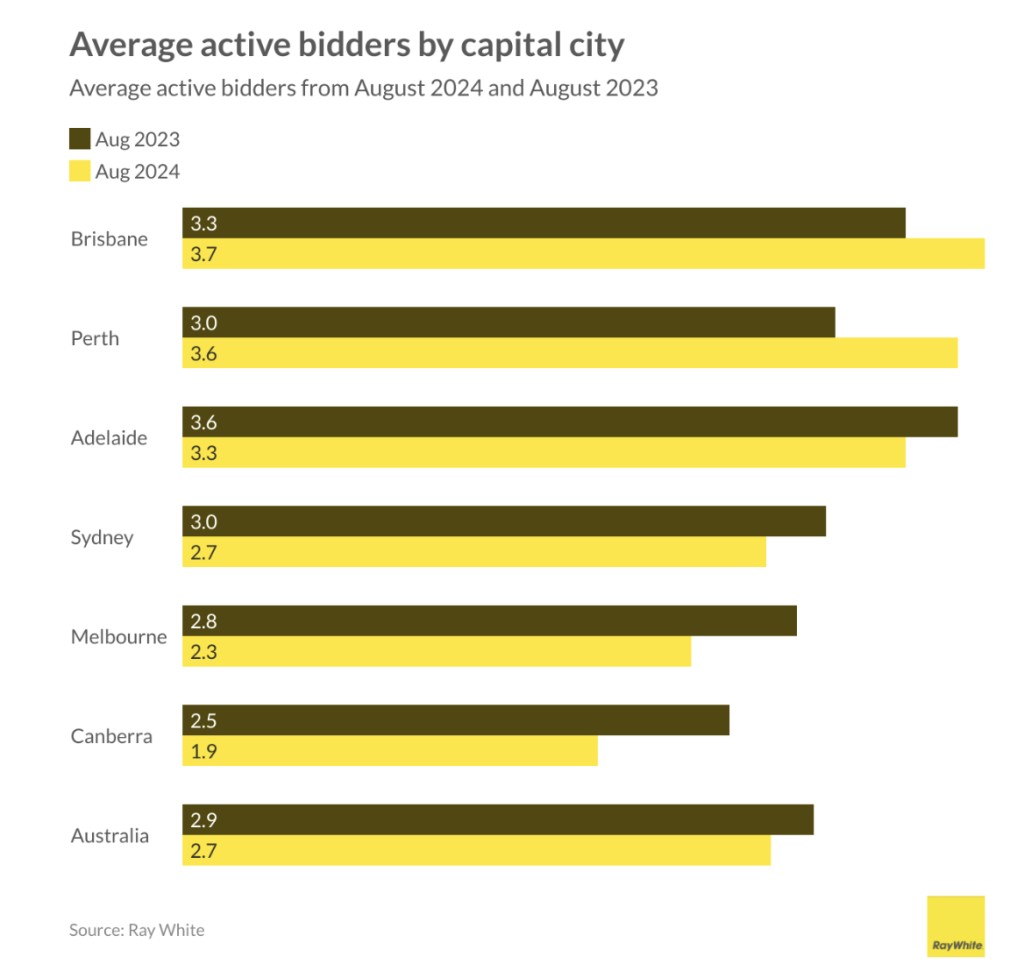

In August, Ray White conducted 3,534 auctions nationally, an increase of 15 per cent compared to the number of auctions held at the same time last year. With auction numbers increasing, we have also seen a fall in the number of active bidders. In August, there were 2.7 people on average actively bidding. This is a decline from 2.9 people from the same time last year.

On an annual basis, this hasn’t made much difference to price growth – year-on-year, it has accelerated since last year. But on a monthly basis, it does seem to have resulted in a slow down. In August last year, prices increased by 1.1 per cent. This August, they increased by 0.5 per cent.

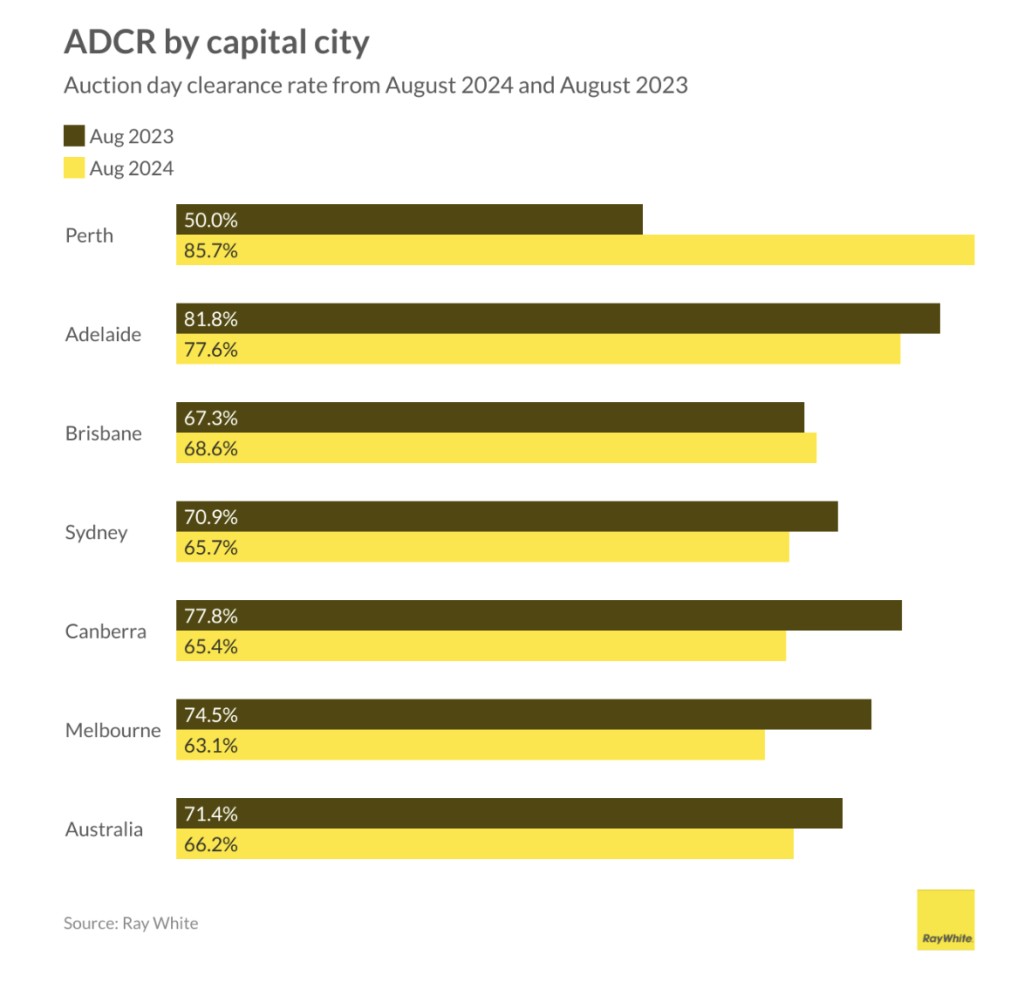

While nationally, there has been a reduction in active bidders and a drop in the clearance rate, it has been disproportionately impacted by slower conditions in Sydney and Melbourne, and to a lesser extent by Adelaide and Canberra. Both Perth and Brisbane have seen an increase in the number of people actively bidding and an increase in clearance rates.

Perth is a very small auction market and hence this data needs to be used cautiously. Notably, Brisbane saw a big increase in auction numbers (up 51 per cent), however average active bidding numbers are now the highest in the country. Both Perth and Brisbane are both seeing accelerating rates of growth, in distinct contrast to slowing growth in Melbourne and Sydney.

From this data, it is likely that the divergence of market conditions we have been seeing over the past few months will continue. Perth and Brisbane look set to continue to dominate price growth, while Sydney and Melbourne slow.